Real estate agents in the leafy suburbs of Bergen County, New Jersey say the current housing market — with historically low inventory and record-high prices — is actually more challenging than the multiple offer chaos they sweated through during the pandemic.

“At the height of the pandemic there were bidding wars and all that, but it didn’t seem impossible, but now it seems impossible to get our buyers into homes,” said Heather Corrigan, a RE/MAX Signature Homes agent based in Closter, a borough that is 24 miles north of Manhattan and renown for its schools.

Altos Research’s Market Action Index score for the county, which has 70 municipalities, illustrates the challenges agents and their clients have faced. In March of 2022, the 90-day average Market Action Index score for the county hit a high of 93.84, before cooling over the past two years to a score of 47.98 as of March 6, 2024. Altos considers any score above 30 to be a seller’s market.

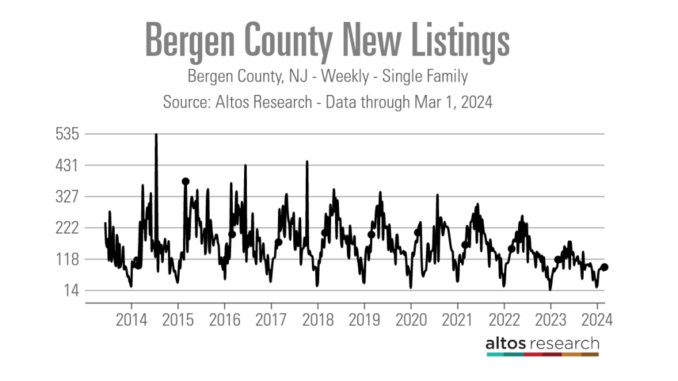

70 towns, 90 new listings

Local agents say the county’s tight inventory situation is largely to blame.

“We have been complaining about the lack of inventory for as long as I can remember, but then we at least had more listings,” Danny Yoon, an Edgewater, New Jersey-based Sotheby’s International Realty agent, said. “I was able to bring my clients to multiple listings for their consideration, but now I can only show them one or two in a given week. There is nothing to show.”

As of March 6, 2024, there was a 90-day average of 570 active single-family listings in Bergen County, according to Altos. This is down from a 90-day average of 752 active single-family listings a year ago and 2,052 active single-family listings in early March 2020, just at the onset of the COVID-19 pandemic.

“Bidding wars are still there but it isn’t as bad as during COVID,” said Lisa Comito, a broker at Howard Hanna Rand Realty and the president of Greater Bergen Realtors, which has nearly 9,000 members. “When we were coming out of COVID we were seeing 15 to 20 offers on a house, where you’d have to make a spreadsheet to show your seller. You aren’t getting that, but there is still a lot of competitive bidding.”

Like elsewhere in the country, agents blame the low interest rates of 2020 and 2021 for locking many would-be sellers into their homes.

“During the pandemic, people would downsize or sell their home on a whim,” Comito said. “Now it is a different conversation. If they are downsizing it is for quality of life or that they can’t maintain a large home anymore.”

Although agents are optimistic about what may come with the fast-approaching spring housing market, the numbers are not promising. Data from Altos Research shows that there were just 90 new single-family listings in Bergen County for the week ending March 1, 2024. This is the fewest number of new listings for the first week in March recorded in Altos’ data, which dates back to 2013.

“Some of the reports indicate that we are going to have more listings this year than last year, but the only way I can see that being correct is because we had so few listings last year,” Yoon said. “Even if we get more listings, it is not going to be enough for people. We are still going to suffer from lack of inventory.”

Prices climbing toward $1M

While questions remain over how many sellers will decide to enter the market this spring, agents are already seeing more buyers come to the market. That’s despite median list prices climbing to a record $899,000 in the first week of March 2024, up nearly $150,000 from March 2022, which Altos considers the market’s peak.

“There is a meme with two buyers sitting in chairs waiting for prices and interest rates to drop and the buyers are skeletons and I think there is some truth to that,” Corrigan said. “But now buyers are sick of waiting around and are deciding it is time to buy.”

Comito also believes the current interest rate environment is helping to encourage buyers to enter the market.

“Buyers right now have gotten more comfortable with the mortgage rates,” Comito said. “They have stayed pretty consistent, allowing people to adjust to them and they aren’t thinking as much about those low rates of the pandemic market.”

While buyers are facing inventory and interest rate challenges, agents say they are also facing competition from investors and the all-cash offers they are capable of making.

“I have well qualified clients who are putting down 25% and are coming over asking with no or limited inspections and they are getting beat out by investors with all-cash,” Corrigan said.

She noted that while some of the investors are larger corporations, there are also a lot of mom-and-pop investors out in the market, buying up inventory.

Comito noted that even first-time buyers are looking to get into rental properties.

“You are seeing first time buyers looking for multifamily properties where they can rent out the other units to help pay for their mortgage,” Comito said.

Even with the challenging housing market conditions, buyers are still flocking to Bergen County, and agents like Corrigan don’t see that changing.

“The schools are good, and everything is in close proximity,” Corrigan said. “Every town has its own unique features, whether it is a great library, the town pool, events they put on, great restaurants, it is really just a desirable place to live for so many people.”