The value of city buildings is sinking under the weight of high interest rates, crippling regulations and large vacancies caused by work-from-home and pandemic downsizing.

Many properties are now worth no more than their debt, and they’re still not selling. According to the Real Estate Board of New York, sales in 2023 were the lowest since 2009.

“Most buildings are worth less now than a year ago, if only by virtue of the increase in cap rates and interest rates,” said Michael Cohen of Williams Equities. Moreover, trillions of dollars in debt will soon come due, warned Rob Gilman, CPA and co-leader of Anchin’s real estate group.

In this pivotal time, the recent sales of $60 billion in failed Signature Bank loans — the largest in history with thousands of properties — will be liquidated over the next several years, providing guidance on new market values. Doug Harmon’s team at Newmark handled that deal.

“We are in the early stage of a reset of property values,” said Peter Braus of Lee & Associates NYC. “In 2024, we will see the acceleration of the difficult environment for owners who have been treading water.”

While many owners “are tied to lower values and high loans,” according to Andrew Scandalios of JLL, opportunities abound for buyers ready, able or willing to transact. James Nelson of Avison Young noted that those tend to be foreign buyers and sellers.

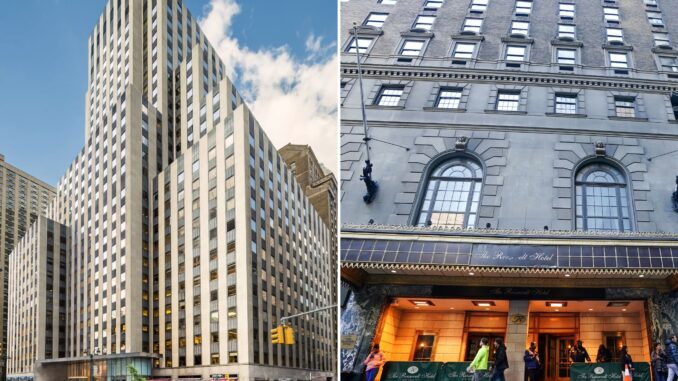

One of the most significant buildings set to hit the market this year is the Roosevelt Hotel at 45 E. 45th St. Its owner, the government of Pakistan, is hiring JLL to make the deal.

On the buy side, a Monaco-based family office paid $38 million for 144 Fulton St., which is leased to the world’s largest Chick-fil-A. Japanese coffee company, Geshary, spent $38 million for 520 Fifth Ave. The Mori Trust Co. of Japan paid $998 million for a 49.9% stake in 245 Park Ave. And Korea’s Hyundai Motors spent $22.5 million for the Liberty Inn at 500 W. 14th St. and $275 million for the brand-new 15-17 Laight St. space.

“We built an irreplaceable asset, and the global market received it extremely well,” said Richard Coles of Vanbarton, the Laight Street developer.

The market for multi-family apartments with regulated rents is stalled because renovations are limited to $15,000 per decade, which “barely scratches the surface” of maintenance costs, said Ben Tapper of Lee & Associates NYC. Nevertheless, Nelson said several such buildings have been sold to Japanese buyers “who can take a long-term view.”

“Many buyers have left the market, and the rest are going bargain hunting and not buying unless it’s a steal.”

Empire State Realty Trust (ESRT) sold office buildings in Westchester and to comply with the so-called IRS Section 1031 tax exchange rules, took the proceeds and bought retail buildings in Williamsburg and a luxury apartment building at 298 Mulberry St.

“For a 1031, you can acquire within the time frame — but be prepared to overpay,” said Anthony Malkin of ESRT. “Be content with the fact you bought the best and, over time, it will retain the best value.”

But not all are so lucky. Some large institutional owners are simply giving up and “handing back the keys to the lenders,” said Woody Heller of Branton Realty. “We are accustomed to people doing what they need to do to buy time with the lenders, so this is a fundamental shift in the marketplace.”

That’s what happened at the office building at 300 E. 42nd St. at Second Avenue. That building’s more than $100 million loan is being marketed by JLL. More dramatic, in 2014, Blackstone bought 1740 Broadway for $608 million with a $308 mortgage. Tenants left, it’s worth $175 million and JLL will sell for the lender.

Meanwhile, ground leaseholders have walked or may be forced out of office properties where office rents cannot cover costs. Just look at Shorenstein, which paid $330 million in 2015 for the leasehold at 1407 Broadway on land owned by the Goldmans. Its $350 million loan went to special servicing in November.

When will things improve? “Maybe in 2026,” said Greg Kraut of KPG Funds. “That’s a long time, so it’s very challenging.”

But some owners are starting to see light at the end of the tunnel and they are waiting. “People have a compelling reason to think rates are going down, so only a few are still transacting,” observed Bob Knakal of JLL.

Still, you have to be “a really smart analyst and appraiser to read the tea leaves,” added Adelaide Polsinelli of Compass. “Many buyers have left the market, and the rest are going bargain hunting and not buying unless it’s a steal.”

Real Estate – Latest NYC, US & Celebrity News