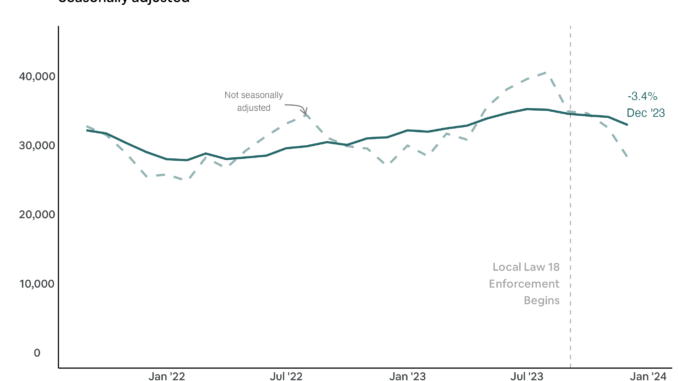

Four months after New York City’s restrictive short-term rental rules went into effect, a new analysis of publicly available data reveals no discernible improvement in rental prices or housing inventory in the city. Key findings include:

Rents remain unaffected: Across the city, rents in December increased by 2.3% from a year earlier, according to Apartment List’s rental index. While the first half of 2023 was marked by a downward trend in rental growth rates, the minor increase in December demonstrates the loss of thousands of short-term rental listings has not led to an immediate improvement in rental affordability.

A precipitous drop in short-term rental listings in NYC has not translated to a surge of apartment inventory: An Airbnb analysis of data from StreetEasy, a real estate listings company, shows available rental inventory across New York City fell by 6.3% since August, when adjusted for monthly seasonality. Apartment List, which maintains an NYC vacancy index, reported the share of rental units available for rent in December remained at 3.2%––unchanged from September.

Housing inventory remains tight: An analysis of StreetEasy data also shows little growth in the number of homes up for sale since September. In December, the net increase in for sale inventory over the previous three months was actually smaller than the three months ending September—increasing only 2.9% from September, adjusted for monthly seasonality, down from 3.5% growth between June and September, before Local Law 18 went into effect.

“New York City is one of the most expensive cities in the world and faces a decades-long chronic shortage of housing. Many have argued that removing the ability to host short-term renters will open up tens of thousands of available rental units in the city, yet, more than four months after New York City’s short-term rental rules went into effect, there has been no detectable increase in available rental inventory and rents have only risen further. Policymakers should continue to focus on reforms that encourage new housing construction throughout the region to address the root cause of the affordability challenges.” said Taylor Marr, Senior Housing Economist, Airbnb.

It’s important to note that following a post-pandemic market rebound, analysis from RealPage shows the New York City rental market began cooling months before Local Law 18 took effect due in part to an influx of new units from recently completed construction. Thus, while the rental market in NYC has been benefiting from nearly 12,000 new units completed in the past year, the new short-term rental rules have not contributed to an influx of additional rental inventory in recent months.

Higher hotel prices and an unregulated black market for short-term rentals

Since September, New York City has also experienced higher hotel prices and the development of an underground market for unregulated short-term rentals. According to the Trivago Hotel Price Index, this past holiday season, the price of an average hotel room increased by nearly 20%, which was 8% higher compared to last December. Reports also indicate some short-term rental activity has moved to unregulated sites that are not subject to the same regulatory scrutiny by the city.

####

The post Four months later: An update on New York City’s short-term rental rules appeared first on Airbnb Newsroom.