PrimeLending, a Texas-based retail mortgage bank, added 12 new loan originators as it attempts to grow market share within its existing Texas footprint.

Among the newly added LOs in the fall included two LOs — John Muhammad ($25.72 million) and Hugo Ortiz-Pulido ($21.21 million) with a production volume of more than $20 million year-to-date, according to mortgage tech platform Modex.

Hiring high-performing LOs has been PrimeLending’s strategy in large part because it’s a tough market to execute mergers and acquisitions (M&As), Gene Lugat, executive vice president of strategic support at PrimeLending, said in a previous interview with HousingWire.

“We are dialing down data, metrics and information that allow us to target communities and markets where we again think we have a competitive advantage and we’re using that strategy across the country,” Lugat had said.

“We would prefer to be picking up the loan officers without the branches, without physical locations because we’re trying to backfill into where we have existing retail opportunities and we have space.”

PrimeLending has been on a hiring spree to bring on high-performing LOs in 2023 to its existing branches.

In June, the lender brought on 100 loan officers and hired 33 additional LOs based in Texas since that period.

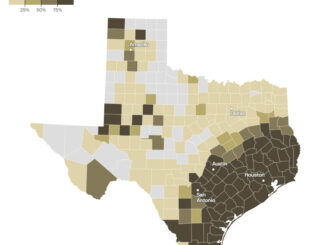

Lugat had noted the mortgage bank’s opportunity to grow in the entire Southwest regions and Texas in particular.

PrimeLending has 934 registered mortgage loan originators across 192 active branches across the country, according to the Nationwide Mortgage Licensing System (NMLS).

Led by president and CEO Steve Thompson, Prime Lending ranked as the 35th largest mortgage lender as of the first nine months of 2023, with an estimated origination volume of $6.4 billion, data from Inside Mortgage Finance showed.

Production from January to September declined about 39.5% from the same period in 2022 as with most of the lenders in the industry.

PrimeLending has a market share of around 0.6%, lagging behind its goal to increase its market share to 1% this year.