What a week! Mortgage rates almost fell below 7%, the 10-year yield is below 4.25% again, and people are seriously talking about Fed rate cuts in 2024. Times can change quickly, which is why we created the weekly tracker so you have the information you need in real-time.

Purchase application data

Hello, early Christmas present! Mortgage rates have fallen by almost 1% in a short time, and it has created four straight weeks of positive purchase application data. I recently covered this noteworthy topic on the HousingWire Daily podcast because we need to add some reality checks with this positive data, but we also stress that people can’t make the same mistake as last year of ignoring the positive forward-looking data.

Last week, purchase apps were up 5% over the previous week, making the year-to-date count 22 positive prints versus 23 negative prints and one flat week. We have a few weeks left for the year and with mortgage rates falling as much as they have, we might end up positive on the year-to-date count.

Mortgage rates and the 10-year yield

We are back! The 10-year yield closed below 4.25% again and mortgage rates ended the week at 7.09%. For my 2023 forecast, my range for the 10-year yield was 3.21%-4.25%, which meant mortgage rates between 5.75%-7.25%. I said the 10-year yield would only break below 3.37% if the labor market breaks — this level is the “Gandalf line” I have used all year.

Now, in order to get above 4.25% on the 10-year yield, we needed the economy to outperform. In Q3, the U.S. economy grew above 5%, and jobless claims headed lower. That economic growth and lower jobless claims data, on top of the Fed being hawkish at their Fed meeting, sent the 10-year yield over 5% making the Fed policy very restrictive. This is not what they wanted after all their rate hikes.

However, those are over for now. Mortgage rates went from 7.32% to end the week at 7.09%. If the spread between the 30-year mortgage rate and 10-year yield were behaving normally we would be talking about mortgage rates under 6% today!

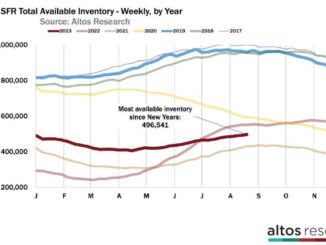

Weekly housing inventory data

It’s December, which means the seasonal decline in housing inventory is well underway, which means in 2023, I have batted a whopping zero on how much I predicted weekly inventory would grow with higher mortgage rates. The call was that if mortgage rates rose above 7.25%, we would see more inventory growth — between 11,000-17,000 weekly. That hasn’t happened once this year. The closest we got to this level was when inventory grew for a few weeks by about 9,000 and it did grow faster with higher rates late in the year, but it never hit my target, so I got this wrong. Now, we see the seasonal inventory decline.

Last year, according to Altos Research, the seasonal peak for housing inventory was Oct. 28. It appears that the seasonal peak this year was Nov. 17.

Weekly inventory change (Nov. 24-Dec. 1): Inventory fell from 565,875 to 555,717

Same week last year (Nov. 11-Nov. 18): Inventory fell from 564,571 to 550,302

The inventory bottom for 2022 was 240,194

The inventory peak for 2023 so far is 569,898

For context, active listings for this week in 2015 were 1,081,712

The one positive inventory story in 2023 is that we formed a bottom in the new listings data! One concern with higher mortgage rates was that more sellers — who are traditional buyers — would not list their homes. This didn’t happen at all this year, even with mortgage rates heading toward 8%. I talked about growth in the new listings data on CNBC as it appeared to me we were forming a bottom months ago.

New listings data for this week over the last several years:

2023: 28,297

2022: 28,471

2021 32,018

Traditionally, one-third of all homes take price cuts before they sell. When mortgage rates rise and demand decreases, the percentage of homes with price cuts usually increases. However, even with mortgage rates reaching 8% this year, we trended 4% below 2022 levels of price cuts. This explains why home prices are more firm in the second half of 2023 versus the same period in 2022.

Price cut percentages this week over the last few years:

2023: 39%

2022: 43%

2021: 27%

The week ahead: Jobs week!

Yes, it’s that time of the month again: Jobs week! We have had a big move in bond yields already, and we are staring at four labor data reports this week: job openings, ADP, jobless claims, and jobs Friday. We should get a slight boost in the jobs report from the labor strikes being over. However, it will be interesting to see how the bond market reacts to each labor report.