A Taylor Swift-inspired auction, two cities scoring major international events and a surprising number of people wishing for the housing market to crash. From the wild and wooly world of real estate, here are the hits and misses for the week of Nov. 27 to Dec. 1.

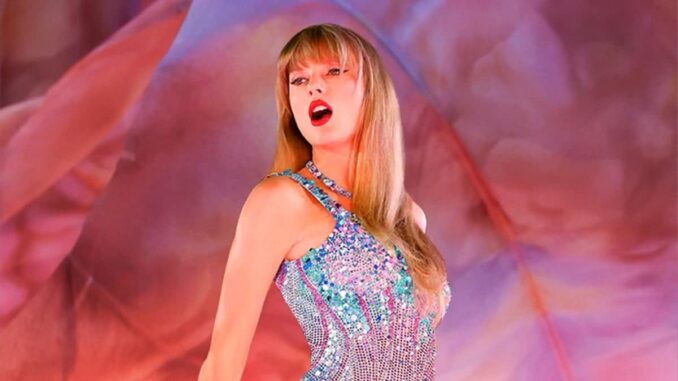

Hit: Taylor Swift to the Rescue. This year, Taylor Swift brought thousands of people into concert venues and movie theaters, and now she’s helping to get deserving people into homes. Or, to be more precise, a Swift-signed acoustic guitar is being made available in an online auction to help raise funds for Wider Path Home Foundation (WPH), a nonprofit focused on promoting sustainable homeownership among underserved communities. WPH President Brian Gilpin said it best: “With Tayor Swift’s popularity soaring—and deservedly so—this auction presents a remarkable opportunity for supporters to contribute directly to our cause, helping us build stronger, more vibrant communities. Plus, it would make an incredible holiday gift for one lucky Swiftie!”

Hit: Return to Utah. Congratulations to the Salt Lake City-Utah Committee for the Games, which earlier this week learned the International Olympic Committee executive board named the Utah capital as the preferred host for the 2034 Winter Olympics and Paralympics. Salt Lake City previously hosted the games in 2002, which was one of the rare recent Olympics to end with a financial surplus. The IOC will formally decide on the games’ location next October, but this vote of approval makes Salt Lake City an all-but-certain choice to host the winter sports world again.

Hit: Meet Me at the Fair. Also this week, another international organization awarded a significant global event to a major city: The Bureau International des Expositions (BIE) voted to have Expo 2030 in the Saudi Arabian capital of Riyadh. The Expo – which previous generations knew as the “World’s Fair” – will enable the Saudis to host nations, corporations and nonprofits under the theme “The Era of Change: Together for a Foresighted Tomorrow.” While some critics of the Saudi government criticized the BIE for overlooking the kingdom’s record on human rights, winning this event was a major triumph for a government trying to build its political and economic power while strengthening its capital city’s real estate potential. “World Expo has great appeal for the Saudi leadership,” said Kristin Diwan, a senior resident scholar at the Arab Gulf States Institute in Washington, in a New York Times interview. “The Saudis are determined to have a big coming-out party in 2030 to show the success of their vision.”

Hit: Saying the Right Thing. Kudos to Mortgage Bankers Association President and CEO Bob Broeksmit for calling out the Department of Veterans Affairs’ (VA) request that servicers pause foreclosure proceedings of VA-guaranteed loans through May 31, 2024. While Broeksmit affirmed the MBA’s commitment to helping veterans who are homeowners, he nonetheless stated the trade organization has “significant concerns on the implementation of the voluntary foreclosure moratorium,” adding the “VA needs to provide a detailed plan on how servicers will be reimbursed for advancing payments on behalf of borrowers.” We’ll be waiting to hear the VA’s response.

Miss: Wishing Bad Thoughts. A new LendingTree survey of 2,000 adults found 44% of respondents stating the housing market is at risk of crashing in the next year. But the real surprise of this survey was the 36% of homeowners who wanted the market to crash – within this fatalistic group, 15% said a crash will help to lower their property taxes and 15% believed it would lead to future economic stability. LendingTree Senior Economist Jacob Channel diplomatically observed, “I can understand why some might wish for a housing crash that brings lower prices. Unfortunately, if the national housing market were to crash, odds are that it would bring down the rest of the economy with it.” Seriously, be careful what you wish for!