For the fourth consecutive month, homebuilder confidence sank in November, according to the National Association of Home Builders/Wells Fargo Housing Market Index published last week. The pessimistic streak is especially notable given that the fall months have recently been lucrative for builders.

The index fell to 34 in November, well below the 50 mark that divides bullish and bearish sentiments. However, the dour mood was not universal. Confidence rose in the Northeast to 53, signaling that builders there are slightly optimistic about market conditions.

In fact, builders in the Northeast were almost twice as optimistic as those in the West, where the HMI sank to 28.

Builders’ pessimism may be tied to price cuts, which were common in the West in the last month but comparatively rare in the Northeast. Almost half – 47% – of Western builders say they cut prices, about triple the Northeast’s 16%.

The Western pessimism is also unsurprising given the year-over-year declines Western states have seen in home values.

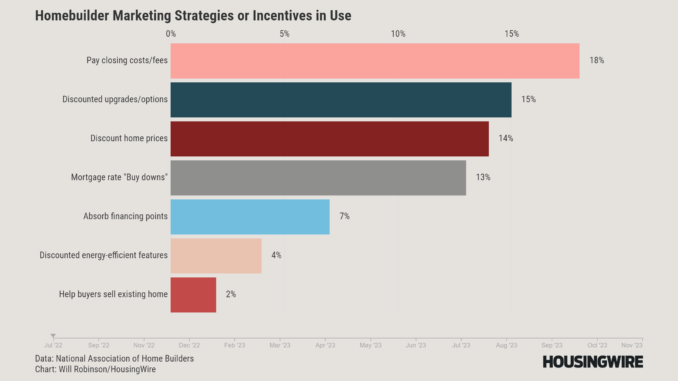

Price cuts are not the only way builders are fighting for sales. Builders reported covering closing costs, offering discounted or free features, helping buyers sell their existing home and providing other incentives.

Builders have used these incentives in recent months to avoid an inventory glut.

The sales boom that followed the onset of the pandemic caused the months’ supply of new homes to fall roughly 40% from September 2019 levels, inviting builders to bring more units to market. They did, just in time for a slew of interest rate hikes to depress buyers’ appetites.

With mortgage rates slowing homebuying, the monthly supply for July 2022 reached a level 87% higher than Sept. 2019. But builders persevered in selling units, getting inventory off their balance sheets through price cuts and other methods, and have brought months’ supply down to only 28% above the Sept. 2019 level.

But boosting sales is only one part of keeping supply in check. Builders also have to consider how many new units to bring to market.

Builder activity surged as sales soared, then nosedived as rates increased. Builders ended 2021 with seasonally adjusted annual rates of units started and units authorized that were 34% and 27% higher than October 2019 levels, respectively.

In the months that followed, units authorized cratered to 12% below the October 2019 level and remain below it as of October 2023, although housing starts rose modestly that month.

If the nation’s largest homebuilder, D.R. Horton, is any indication, 2024 will look a lot like 2023, the company stated in its annual report last week.

“To adjust to changing market conditions and higher mortgage interest rates during fiscal 2023, we increased our use of incentives and reduced home prices and sizes of our home offerings where necessary to provide better affordability to homebuyers,” the report states. “Based on current market conditions, we expect to continue offering a higher level of incentives in fiscal 2024.”

The company has also slashed its inventories by about a third in recent quarters, dropping from almost 60,000 homes in March 2022 to 42,000 this September.