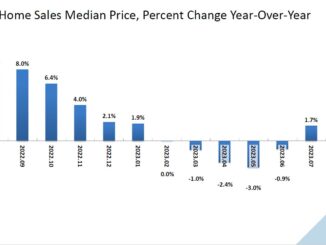

Home prices have resumed their upward climb despite mortgage rates that have doubled post-COVID. According to Craig J. Lazzara, Managing Director at S&P CoreLogic Case-Shiller Indices, the National Index for July hit an all-time high. That index, which covers all nine U.S. census divisions, rose 1.0 percent from the previous July, after posting zero change on an annual basis in June. The 10-City Composite showed an increase of 0.9 percent after a 0.5 percent loss the previous month and the 20-City Composite was up 0.1 percent, improving from an annual loss of 1.2 percent. Chicago, Cleveland, and New York led the way for the third consecutive month reporting the highest year-over-year gains among the 20 cities in July. Chicago remained in the top spot with a 4.4 percent increase, with Cleveland (which has long vied with Detroit for the low spot in Case-Shiller’s numbers) was second, with a 4.0 percent annual gain. New York held down the third spot with a 3.8 percent increase. Eight of 20 cities reported lower prices and 12 of 20 reported higher prices in the year ending July 2023 compared to prior annual numbers. Eighteen of the 20 cities accelerated at a higher rate than in June. Lazzara said, “We have previously noted that home prices peaked in June 2022 and fell through January 2023, declining by 5.0 percent in those seven months. The increase in prices that began in January has now erased the earlier decline, so that July represents a new all-time high for the National Composite. Moreover, this recovery in home prices is broadly based. As was the case last month, 10 of the 20 cities in our sample have reached all-time high levels. In July, prices rose in all 20 cities after seasonal adjustment and in 19 of them before adjustment.