Indiana-based First Savings Bank plans to lay off over 100 mortgage employees in the coming months, according to documents filed with authorities in multiple states. News of the plans come as political instability and a strong job market push mortgage rates closer to 8%.

“First Savings Bank has planned a layoff in which a significant portion of impacted employees are considered remote or virtual employees in multiple states,” Julie Bleich, senior vice president and human resources director, wrote to the Department of Labor and Economic Opportunity in Michigan on Sept. 29.

Executives at First Savings Bank did not immediately respond to HousingWire’s requests for comments.

Worker Adjustment and Retraining Notifications filed with state regulators show that First Savings Bank will permanently reduce the number of employees by 135 at its mortgage banking division in November and December.

In Michigan, 18 will be impacted on Nov. 30, including loan originators, processors and non-producing managers. Five will be affected in North Carolina on the same date. Meanwhile, in New York, the bank will lay off two employees on Dec. 28. Three staffers in Arizona are also included in the job cuts.

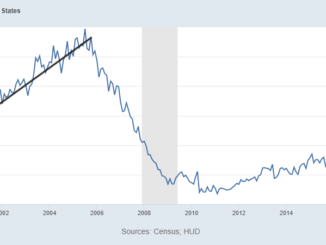

First Savings Bank, controlled by First Savings Financial Group, originated about $200 million in mortgage loans over the last 12 months, per the mortgage tech platform Modex. Its volume declined from $1.1 billion in 2021 to $370 million in 2022. And the bank has about 46 active loan officers in 57 branches, the data shows.

An entrepreneurial community bank headquartered in Jeffersonville, First Savings operates 15 depository branches within southern Indiana. It has three national lending programs: single-tenant net lease commercial real estate, SBA lending and residential mortgage banking.

The bank reported a net income of $2.3 million for the quarter ending in June 2023, compared to $2.6 million in the same period of 2022.

Regarding the company’s performance, Larry Myers, president and CEO, stated, “The underperformance of the mortgage banking and SBA lending segments are recognized, but the macroeconomic environment for these businesses to perform well continues to improve.

“This challenging environment for the banking industry will pass, but as it persists, we’re active to realign the balance sheet, stabilize the margin, manage expenses and make select investments in opportunities that will be fruitful in future quarters and years,” Myers added.