Amid high mortgage rates and high home prices, it’s easy to forget another factor in housing affordability: rising property taxes. These taxes are another rising cost affecting housing affordability and buyers’ appetites, and their impact is outsized in certain metro areas.

The big picture

There’s no doubt property taxes are on the rise and have risen faster since the start of the pandemic when housing prices started to soar.

The median amount paid in real estate taxes in the U.S. rose 51.9% over the 10-year span from 2012 to 2021 — even after adjusting for inflation, according to a HousingWire analysis of U.S. Census Bureau data from the American Community Survey.

The median tax paid rose even faster in the West (as defined by the Census Bureau), rising roughly 59% in 2021 dollars over that span. However, the median tax paid in the Northeast still vastly exceeds the medians of the other regions and the national median. The median Northeasterner in 2021 forked out $5,132, almost doubling the national median of $2,690.

Overall, the U.S. pulled in more than $295 billion from real estate taxes in 2021 by Census Bureau estimates. That is 8.2% — or about $22.5 billion — more than the previous year. Revenues from real estate taxes rose even faster in the West (9.5%) and South (9.2%).

States where taxes hit hardest

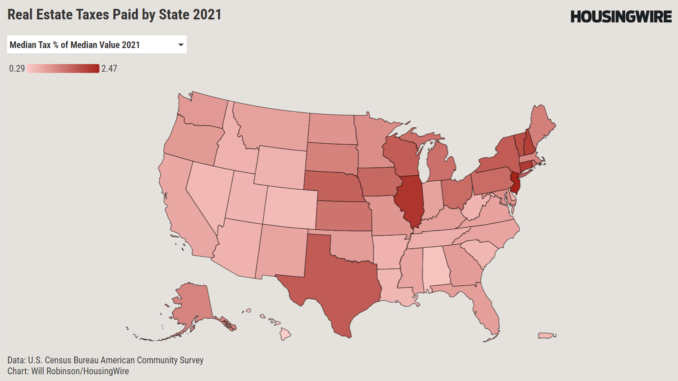

To find the highest typical tax payments, look to the states with the highest property values. Unsurprisingly, you would find large median values in New Jersey ($8,797), Connecticut ($6,153) and New York ($5,884).

With that criteria, however, you would be dumbfounded by Hawaii. The state has by far the most expensive home values in Zillow’s Home Value Index, but its median amount paid in real estate taxes in 2021, $1,893, ranks between Georgia and North Dakota.

For a better sense of taxation levels independent of home prices, consider the median amount paid in real estate taxes to the median property value. By that measure, New Jersey’s 2.47% is the highest in the nation, followed by Illinois at 2.23%, Connecticut at 2.15% and New Hampshire at 2.09%.

Hawaii is the lowest in the nation at just 0.29%, followed by Alabama at 0.41%, Colorado at 0.51% and Nevada and Puerto Rico, both at 0.55%.

It is also worth considering where the growth in the median real estate tax payment outpaced the growth in the median property value and vice versa. Here are the top 10 for each:

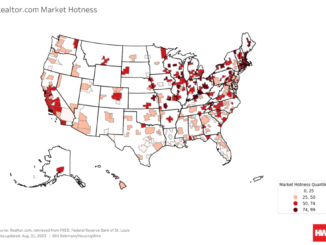

Metro areas where taxes hit hardest

Many of the metropolitan statistical areas with the highest median tax paid in 2021 are the cities with the highest property values — cities like New York, San Francisco and Austin. The MSAs with the highest median taxes as a percent of their median property values, however, are almost exclusively in New York and New Jersey.

MSAs in Alabama and Puerto Rico, by contrast, dominate the list of least expensive both by dollar amount and percentage of median value.

The figures in this article are based on the five-year estimates from the survey, for which 2021 is the most recent available data. Only the less precise one-year estimates have published for 2022.