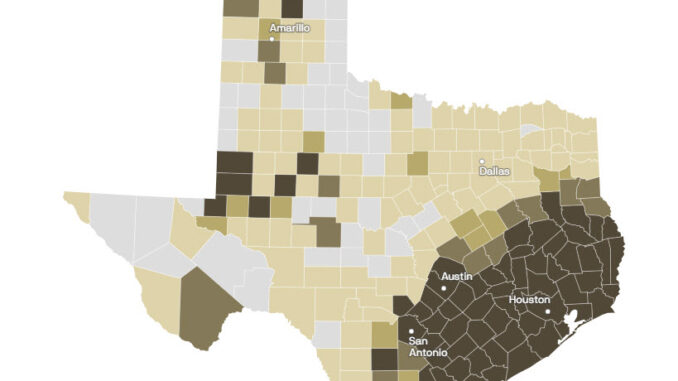

Nearly 88% of properties in the Austin metro area could be facing higher insurance premiums or policy non-renewals due to the risk of wildfires, high winds, and flooding, Axios’ Brianna Crane and Kavya Beheraj report, based on a new analysis.

Driving the news: Insurers are changing how they factor climate and extreme weather risks into premiums, and Texas is among the states with the steepest increases in homeowners insurance premiums since last year.

The big picture: Millions of properties nationwide could see higher premiums because of these climate- and weather-related risks, per estimates from the First Street Foundation, a climate data nonprofit.

- Nearly 24 million U.S. properties may face higher premiums because of the risk of potential wind damage, about 12 million because of the risk of flooding, and about 4.4 million due to wildfire risk.

Zoom in: The Austin area has seen its share of costly weather events just this summer, including this week’s baseball-sized hail that damaged roofs, shattered windows and dented cars.

- Though too much rain hasn’t been a problem lately, Central Texas is known as flash flood alley.

- Roughly 87% of Austin area properties are at risk of an insurance rate increase because of wind-related risks and 5.4% because of flood-related risks, according to First Street Foundation.

Yes, but: Despite our area’s rising risk of wildfires, premiums for homes in Central Texas are unlikely to see a rise in home insurance premiums due to wildfire risk, according to First Street Foundation’s analysis.

What’s happening: When it comes to wildfire and wind damage, some private insurers are dropping policyholders as the risk of those threats grows, says Jeremy Porter, First Street’s head of climate implications research.

- That’s leading many homeowners to opt for public “insurer of last resort” plans — but often at higher rates.

Between the lines: Climate and extreme weather risks — and the associated financial costs — are slowly starting to influence where people choose to live, Porter says.