- The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 7.16% from 7.09%.

- Mortgage demand from homebuyers was 26% lower than the same week one year ago.

- Applications to refinance a home loan fell 2% for the week and were 35% lower than the same week one year ago.

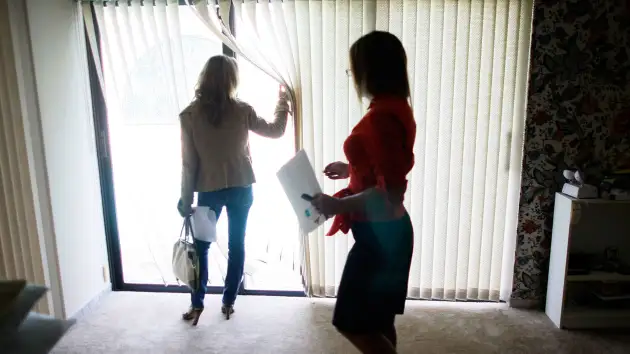

Mortgage rates rose for the third straight week last week, matching a 22-year high. As a result, mortgage demand dropped as well.

Total mortgage application volume was 29% lower than the same week one year ago, according to the Mortgage Banker’s Association’s seasonally adjusted index.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 7.16% from 7.09%, with points decreasing to 0.68 from 0.70 (including the origination fee) for loans with a 20% down payment. That was the third straight weekly increase and the highest level since October 2022, which also matches a high level seen in 2001.

“Treasury rates were elevated again last week following mixed data on inflation and more indication of resiliency in the economy, which may pose a challenge to the Federal Reserve’s efforts to lower inflation,” said Joel Kan, an MBA economist, in a release.

Loading…

Source: www.cnbc.com

ENB

Sandstone Group