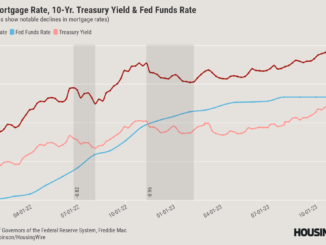

(Reuters) – U.S. Central Bankers, less than a week after raising interest rates for an 11th time since March 2022, expressed hope they can beat inflation without cratering the job market, though they also said doing so will require keeping rates high for some time.

“I’m kind of, I’m closet optimistic … my forecast is that we manage this, that we walk the fine line of the path that we get inflation down, not immediately but at a reasonable pace without a big, a huge increase, in unemployment,” Chicago Federal Reserve Bank President Austan Goolsbee told Reuters on Tuesday.

“Hopefully we’re going to continue to see improvement on the inflation front; I kind of think that’s the key driver of our thinking and decision-making coming out of the last meeting, but also going into the next one.”

Goolsbee last week joined fellow U.S. central bankers in a unanimous decision to raise the Fed’s policy rate a quarter of a percentage point, to a target range of 5.25%-5.50%, after skipping a hike at the previous meeting for the first time since they began their rate-hike campaign in March 2022.

Loading…

Source: www.reuters.com

ENB

Sandstone Group