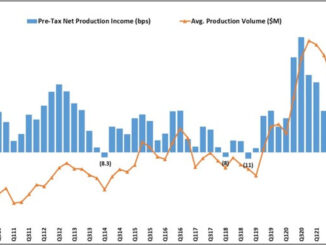

Independent mortgage banks (IMB) reported an average net loss of $534 on each loan originated from April to June, down from $1,972 per loan in the first quarter of 2023, according to the Mortgage Bankers Association (MBA). The average pre-tax production loss was 18 basis points in Q2.

Including both the production and servicing business lines, 58% of retail mortgage companies were profitable in Q2, up from 32% in the first quarter of 2023.

“There were signs of improvement in the second quarter of 2023. Production losses were less severe than the previous two quarters and net servicing financial income was strong,” Marina Walsh, the MBA’s vice president of industry analysis, said in a statement. “Additionally, the majority of mortgage companies in our survey managed to squeeze out an overall profit during one of the toughest times for the mortgage industry.”

The average production volume was $502 million per IMB in the second quarter, up from $398 million per company in the first quarter of 2023. The volume by count per IMB averaged 1,553 loans in Q2, an increase from 1,264 loans in Q1.

However, production revenue was 328 bps in the second quarter, down from 358 bps in the previous quarter. It includes fee income, net secondary marketing income and warehouse spread.

Meanwhile, according to Walsh, after 11 consecutive quarters of increases, origination costs declined by over $2,000 per loan during the second quarter of 2023.

“Volume picked up during the spring homebuying season and additional personnel were shed. However, the substantial cost savings per loan was not enough to put the average net production income in the black,” Walsh said.

Loan production expenses averaged $11,044 per loan in the second quarter of 2023, down from a study-high of $13,171 per loan in Q1. The average number of production employees per company also declined to 366 between April and June from 372 in the previous quarter.

Servicing operating income — which excludes MSR amortization, gains or loss in the valuation of servicing rights net of hedging gains or losses, and gains or losses on the bulk sale of MSRs — was $105 per loan in the second quarter, up from the previous quarter’s $102.

The sale of MSRs does not directly impact earnings as a revenue stream, but the conversion of MSRs into cash via sales deals bolsters a lender’s cash flow and overall liquidity.

The MBA expects mortgage origination volume for one- to four-family homes to post $468 billion in Q3, a rise from $463 billion in Q2 2023, according to its latest forecast.

The MBA also projected the 30-year fixed mortgage rate to trend up to an average of 6.6% in the second quarter, ultimately declining to 5.9% by the fourth quarter of 2023.