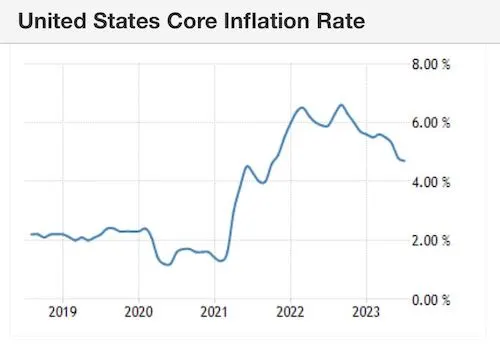

Has the recent inflation data given the Federal Reserve a pathway for a 2024 pivot? The Fed has whispered about what can happen if the inflation growth rate falls more into 2024 and it’s a positive take. Some have thought the Fed would need to keep the fed funds rate elevated for years until they see 2% core PCE data. However, I believe there could be another path for 2024.

First, let’s look at today’s CPI inflation data. It came in a bit lighter than expected — no real surprise here.

From BLS: The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2 percent in July on a seasonally adjusted basis, the same increase as in June, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all-items index increased 3.2 percent before seasonal adjustment.

However, once you strip out rent — which is what the Fed has told us they want to focus on because of the lag in rent data — the growth rate of inflation is falling more noticeably. The Fed is focused on core service inflation less shelter. If you take CPI data in total and subtract the shelter data, inflation data has collapsed.

90% of the inflation growth came from the shelter data, which we know needs to catch up to the reality that the data line below is much lower in real terms.

How can this lead to a 2024 pivot if we don’t have a job-loss recession? This is a good question, as I am not a Fed pivot person until the labor market breaks. For me that means jobless claims data gets above 323,000 on the four-week moving average. Today we did see a spike in claims data. However, the four-week moving average is still 231,000, far from my Fed pivot level.

So why would we see a Fed pivot if labor is still good? In a recent interview with the New York Times, the Fed mentioned something that can set the groundwork for the Fed to cut rates without a job-loss recession. They talked about real yields being restrictive. A simple way to think about this is that with inflation falling and rates up as much as they are now, the Fed believes their Fed Funds rate is at restrictive levels currently.

At first, that could make it sound like they don’t want to hike again. However, if the growth rate of inflation falls even more, then the Fed can change its tune in 2024, even cutting rates next year to make policy less restrictive.

Of course, economic data matters here; if the economy picks up steam and inflation picks up again, this variable changes. However, if the labor market weakens, they have given the marketplace a signal that fed rate cuts will happen. Even if the labor market stays firm, cuts could happen next year if inflation’s growth rate falls. This doesn’t mean we will see massive rate cuts soon, but it does lay the foundation for a less hawkish Fed going into 2024.

So far the bond market has had a mild response to today’s data. Even with the weaker jobless claims data, we haven’t seen any significant moves this morning. As of this second, the 10-year yield is at 4%.

My 2023 forecast range for the 10-year yield was 3.21%-4.25%, meaning mortgage rates between 5.75%-7.25% for 2023, and that the labor market would be the big driver on bond yields, not inflation. As we can see in the chart above, the growth rate of inflation has fallen, but bond yields are near the highs, not the lows. The economy has stayed firm, and labor hasn’t broken. So far in 2023, my premise of bond yields and labor has held as the economy has stayed firm.

The inflation report was slightly better than expected: we see how much rent inflation now holds up the core side of the CPI data. However, I believe the more critical storyline here isn’t the inflation report today, it’s what it can mean next year if this trend continues. I discuss this topic with HousingWire Editor in Chief Sarah Wheeler on today’s HousingWire Daily podcast.

One of my economic themes over the past year is that you don’t need a job-loss recession to have the growth rate of inflation fall — this isn’t the 1970s. We had a global pandemic, and historically global pandemics are very inflationary early on and then things get better over time. I hope the Fed sticks to this theme for next year and that we don’t need jobless claims to get worse for the Fed to pivot.