Purchase loans continue to claim a larger share of the origination pipeline as refinance opportunities dwindle, according to Black Knight’s originations market monitor report.

In June, purchase locks made up 88.4% of the month’s market mix, a record high. Purchase lock counts were down 31% year over year and 29% compared to pre-pandemic levels in 2019. In other words, nearly nine out of every 10 mortgages originated is a purchase loan.

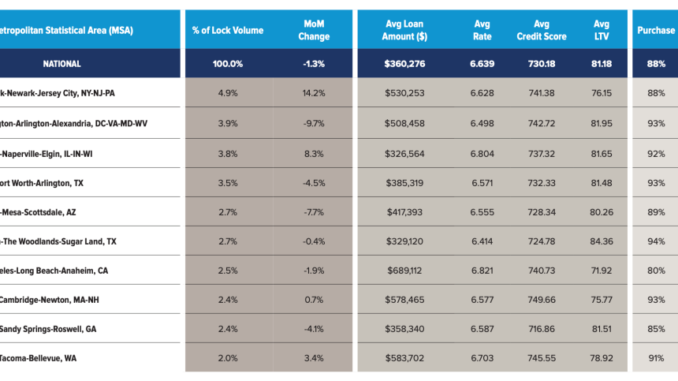

Rate lock activity fell 1% month over month in May, with conforming loans gaining share mainly at the expense of non-conforming loan products. The benchmark 30-year mortgage finished the month 6 basis points (bps) higher at 6.78%.

Purchase lock volumes are down 11% from the end of March and 31% below the volume of the same month in 2022 and cashout refinances fell 16% over the past three months and are 63% below the same month last year. Meanwhile, rate/term refinances decreased 32% over the three-month period and 44% from the same month in 2022. Refi share of lock volume dipped to 11.6%, a new low for this cycle.

“Purchase loans continue to claim a larger share of a shrinking origination pipeline, as refinance opportunities remain scarce. Indeed, we saw the purchase lending share of June’s locks hit another all-time high. But keep in mind: it is a dominant share of a very constrained market,”Andy Walden, vice president of enterprise research at Black Knight, said in a statement.

The average purchase price rose for the seventh consecutive month, to $457,000 with an average loan amount remaining flat at $360,000. Demand for ARM loans dipped slightly to 7.38% of total locks. Jumbo rates increased disproportionately to conforming, resulting in nonconforming locks (including jumbo and expanded guidelines) claiming a smaller share of the pipeline.

Of course, some markets were more purchase-heavy than others. The lowest percentage of refi locks were in the Houston and Minneapolis metros, at just 6%,. By contrast, 20% of locks in the Los Angeles metro were refis in April. Atlanta (15%), Miami (15%), Riverside-San Bernardino (14%), San Francisco-Oakland (14%) also had a higher rate of refis than the national average.

Credit: Black Knight

“As May gave way to June, we saw banks lose some of their appetite for jumbo loans. While the OMBBI 30-year conforming index rose 6 basis points over the month, the jumbo rate index was up by three times that level,” said Walden.

Credit scores for conforming, FHA and VA borrowers improved slightly in the month, suggesting a tightening of credit standards in an uncertain economy.

At the same time, the level of economic uncertainty in the market resulted in historically wide spreads between 10-year Treasury yields and 30-year mortgage rates, and that uncertainty appears to be trickling down to tightening credit standards across the board.

Black Knight researchers found that the purchase pull-through rate was 77.7% in April, up 94 basis points from March. The refinance pull-through rate, however, fell to 61.9%, a 402 bps drop from March.