Six Southern states — North and South Carolina, Texas, Florida, Georgia and Tennessee — now add more to the national GDP than the Northeast, according to a Bloomberg analysis of recently published Internal Revenue Service data.

The transition happened during the pandemic. Millions of transplants brought about $100 billion in new income to the Southeast in 2020 and 2021 alone, while the Northeast lost roughly $60 billion.

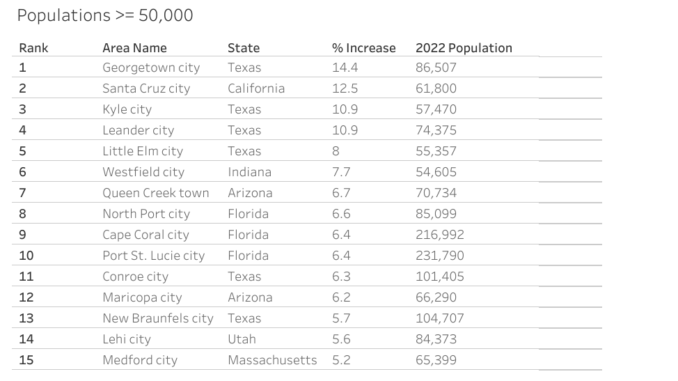

Friends, this is the new New South. And it’s home to 10 of the 15 fastest-growing cities in the U.S.

The growth is real. The question is this: how sustainable is it? And at what point would the new New South resemble the places people are migrating from? Let’s dive in.

Economists at First American did a cool thing recently. They grouped pandemic-era home price growth into four categories for metros: Boom-Bust, Boom-No Bust, No Boom-Bust, and No Boom-No Bust. Take a look.

We can break out all top 50 markets into 4 categories. The first is boom-bust & the example market is Phoenix. Phoenix is emblematic of the expression- the harder they rise, the harder they fall. Prices increased 65% from pre-pandemic to the peak & have declined 10% from peak. pic.twitter.com/rIrPqahD1X

— Odeta Kushi (@odetakushi) July 14, 2023

See that? Home prices and demand rocketed across the New South, and only Austin, Texas, has seen prices drop anywhere close to 10% from the peak (which still means a 55% increase from February 2020). These markets are going to remain hot for the foreseeable future.

CoreLogic data supports this perspective, even if a few markets in Florida are expected to cool down. Miami again posted the highest year-over-year home price increase of the country’s 20 tracked metro areas in May, at 11.8%. Atlanta and Charlotte, North Carolina, saw the next-highest gains, both at 4.4%.

But as ever, follow the money. Tax return data shows just how much has changed from a wealth perspective since the pandemic.

In Miami, the net flow of adjusted gross income for tax filers moving from other states reached $17 billion in 2021, up from $9.6 billion in 2020 and $7.8 billion in 2018, according to Bloomberg.

In Dallas, it reached $5.6 billion in 2021, up from $4.5 billion in 2020 and $3.8 billion in 2019.

Charleston, South Carolina recorded $4.6 billion in 2021, up from $3.8 billion in 2020 and $3.1 billion in 2019.

Jacksonville hit $2.1 billion in 2021, up from $1.6 billion in 2020 and $1.5 billion in 2019.

By contrast, New York, Chicago, LA and DC cumulatively lost $107 billion alone in 2021.

What’s pushing people to move to these areas? It’s simple – affordability and jobs.

“It’s just much cheaper to live here,” said Jon Overfelt, co-owner of American Security Mortgage Corp. in Charlotte, North Carolina. “We hear it all the time – somebody who leaves New Jersey or New York is like, ‘I couldn’t keep up with the taxes.’ I’m like, why did you stay in New York? Or why do you stay in New Jersey with those high taxes? They say because either the schooling – the school systems are good – or it’s family driven. If one of those two changes, they end up here quickly.”

In the Northeast, few homebuilders even attempt to build new single-family homes.

Between regulatory and zoning challenges, NIMBYism and financing costs, the product just doesn’t pencil out. Multifamily is also in short supply, which makes land far more expensive, and keeps costs up. Homebuilders don’t have that problem in the New South.

According to Altos Research, there were just 25,653 single-family homes available for sale in New York and New Jersey as of July 14. Texas alone had 73,223 single-family homes for sale. Florida had 48,474 and Georgia had 18,552. North Carolina had nearly 17,000 single-family homes for sale while Tennessee had 14,650 and South Carolina had 10,539.

The lack of density — sprawl, if you will — is a big factor. Americans have a preference anyway toward car culture and homebuilders have plenty of unbuilt land they bought for pennies on the dollar, and demand is strong in the South.

“If you’re in Charlotte or in Raleigh, if you drive 12 miles out, it gets rural fast,” Overfelt said. “I’m on the lake so the homes are all $2 million and up. But drive three miles down the street and you can buy a brand new D.R. Horton home for $360,000 – 2,000 square feet. That’s where I see a lot of older people from up north. They’ve sold their house for $700,000, $800,000, $900,000 and they buy a house that’s a little bit bigger. Keep the money and they’re just on the outskirts of town anyway.”

Retirees and empty-nesters aren’t the only ones relocating. Corporations are flocking to the South, and they’re taking good-paying jobs with them, according to Census Bureau data.

“We now have more employees in Texas than New York state. It shouldn’t have been that way,” JPMorgan Chase CEO Jamie Dimon remarked earlier this year.

Financial firms, hospitals, biotech companies and car companies have all brought jobs from other areas of the country, Census data shows. Apple is even building a $552 million campus in the Research Triangle area of North Carolina.

Tax incentives have helped lure corporations. Business solutions firm Dun & Bradstreet received a $100 million package of cash and tax incentives to move from New Jersey to Jacksonville. The average employee has an annual salary of $77,000, 25% above the national level and far above most local employers. Many roles pay roughly 15% below the average at the former New Jersey headquarters, and the company is not even halfway to its goal of 500 workers, Bloomberg reported.

People will put up with high taxes in exchange for great cities with top quality services made possible by public investment. But people won’t put up with deteriorating public services and extreme housing unaffordability. Between 2009 and 2019, New York City grew by 907,600 jobs, or 24.3%, attracting 629,057 new residents. But the city only constructed 206,000 housing units. It’s no surprise people fled in 2020 – the Northeast needs to govern better and commit to making housing more affordable or it will continue to lose to the New South.

With more than 2 million people having relocated to New South in the last few years, it’s bound to change the culture. Will it eventually change the housing market and way of life?

“That’s where things get weird and economics work out long term,” Overfelt said. “When they come down here it’s everything they were trying to escape from New York or New Jersey. They always end up saying, ‘Well this is how we did it there.’ Yeah, you had it there, but you were paying for more there.”

My parents are a perfect example. In August 2021 they relocated from Northern New Jersey to Clayton, North Carolina, 15 miles south of Raleigh. They bought their new house in a subdivision all-cash and my stepfather got a part-time job at a golf course down the road. They’ve never been happier, and it doesn’t hurt that they’re saving $15,000 a year in property taxes. But you know what they don’t like? All the new construction in every direction.

“We didn’t have that in New Jersey,” my mother said. Indeed, mom. Indeed.

In our weekly DataDigest newsletter, HW Media Managing Editor James Kleimann breaks down the biggest stories in housing through a data lens. Sign up here! Have a subject in mind? Email him at james@hwmedia.com.