As Commercial Real Estate failure continues to loom in the U.S., some have brought up concerns regarding how this could result in the collapse of some banks.

In a series of tweets on Monday, Nick Gerli, the CEO of Reventure Consulting, detailed how “the commercial real estate crash is happening” and how it could impact small banks across the nation. While speaking with Newsweek on Monday, Gerli explained that commercial real estate owners are currently facing a “double-pronged issue” due to rising interest rates and a decline in revenue in properties.

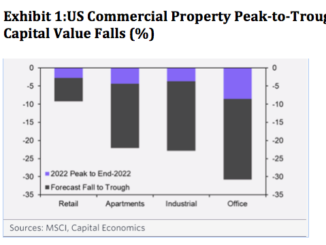

“Values for office, retail, and apartment buildings are already down -11%. Morgan Stanley thinks values could crash -40% when all is said and done. Big problem for US Economy,” Gerli wrote in his tweet.

The tweets by Gerli come amid ongoing concerns about the current state of the commercial real estate market. Last week, Fox Business News reported that by 2025, over $1 trillion worth of commercial mortgage debt is due, but many have concerns that this debt might go into default amid declining property values and high borrowing prices.

Loading…

Source: www.newsweek.com

ENB

Sandstone Group