Borrowers are being warned mortgage rates are set to rise further as turbulence continues to hit the market.

Broker London & Country said lenders had been withdrawing deals and raising rates at a “relentless pace” and this week would “bring more of the same”.

Mortgage rates have gone up about 0.5 percentage points in the last month to approach an average fixed deal of 6%.

On Monday Santander became the latest big lender to temporarily withdraw new deals due to “market conditions”.

About 1.5 million households are set to come off fixed mortgage deals this year and face a sharp rise in their monthly repayments.

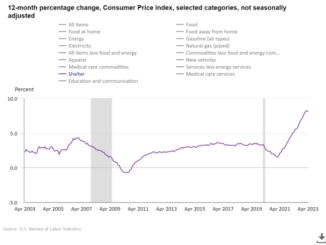

Rates have been rising since recent data showed that UK inflation is not coming down as quickly as expected.

There have been predictions that the Bank of England will raise interest rates higher than previously thought, from their current 4.5% to as high as 5.5%.

It has a direct impact on mortgage lenders, many of whom have raised rates and taken deals off the market over the last few weeks.

In the latest move, Santander said it was “temporarily withdrawing all our new business residential and buy-to-let fixed and tracker rates at 7.30pm on Monday 12 June”.

“We’re relaunching our full new business range on Wednesday 14 June,” it added.

Loading…

Source: www.bbc.com

ENB

Sandstone Group