Commercial real estate – and office buildings in particular – are going through a challenging transition: Climbing interest rates are rippling through the sector at the same time occupants are seeking out newer, more sustainable architecture in new parts of the country.

“There is broadly an obsolescence issue in commercial real estate right now, where you have a significant amount of legacy, old stock, and that’s most pronounced in office,” says Miriam Wheeler, head of Goldman Sachs’ Global Real Estate Financing Group in Investment Banking. At the same time, over the medium term, the sector is poised to attract capital from around the world as investors seek out assets that are better insulated against inflation and geopolitical turmoil, says Neil Wolitzer, a managing director in Real Estate Investment Banking at GS.

We spoke with Wheeler and Wolitzer about the rise in extra yield (spreads) that investors are demanding to buy commercial mortgage-backed securities instead of risk-free Treasuries, the large amount of debt that will mature in the coming years and their expectations for losses and distress.

What’s your view on credit valuations in commercial real estate?

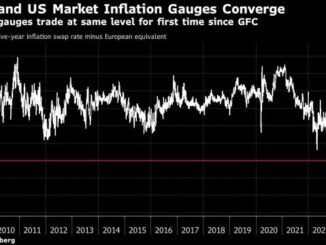

Miriam Wheeler: Let’s take the commercial mortgage-backed securities (CMBS) market, because that’s the most liquid market: We started to see real spread widening and credit contraction in the first quarter of 2022, when the Ukraine invasion happened, and following a record amount of CMBS supply in 2021. Spreads reached a wide in the fall of 2022 amidst continuing rate volatility and questions around future credit performance. We subsequently saw some firmness in the market in January and February of this year. Part of that was the fact that there was very little supply — CMBS supply was down more than 80% in Q1 2023.

Source: www.goldmansachs.com

ENB

Sandstone Group