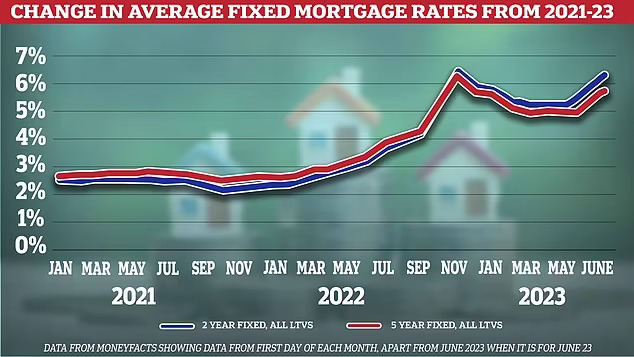

The average price of two- and five-year fixed-rate mortgages in the UK has hit its highest level for seven months, putting further pressure on borrowers who are reaching the end of their deals.

Data from the financial information firm Moneyfacts showed the cost of a two-year deal for homeowners rising to 6.23% on Monday, up from 6.19% at the end of last week and its highest since last November. Meanwhile, the average cost of a five-year deal rose to 5.86%, from 5.83% on Friday.

The rises mean repayments on a £150,000 mortgage taken at the average two-year rate are now £987.65 a month, compared with £660.90 on the average rate of 2.34% available in December 2021, before the Bank of England began to increase borrowing costs.

The figures came as one of the UK’s largest mortgage lenders, Santander, told brokers it was withdrawing its fixed-rate mortgages tonight and would be replacing them tomorrow with loans at a higher rate.

On Thursday the Bank of England increased interest rates by half a point to 5%, in an attempt to curb inflation.

Loading…

Source: www.theguardian.com

ENB

Sandstone Group