On the refinance side, only 407,956 mortgages were rolled over into new ones – the smallest amount this century.

The post Q1 Mortgage Origination Activity at 23-Year Low appeared first on Weekly Real Estate News.

On the refinance side, only 407,956 mortgages were rolled over into new ones – the smallest amount this century.

The post Q1 Mortgage Origination Activity at 23-Year Low appeared first on Weekly Real Estate News.

On Tuesday, the average 30-year fixed mortgage rate jumped back up to 7.34%. That coupled with home prices that rose dramatically during the pandemic, and in some markets, are still rising, has deteriorated affordability. It’s pricing buyers out […]

TORONTO, Aug 22 (Reuters) – Canada’s big bank results are expected to bring to light a number of challenges as lenders set aside more funds for bad loans in a tough economy that has also […]

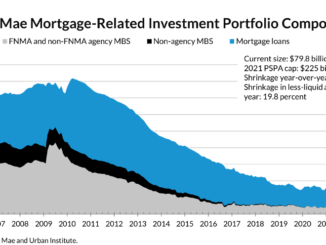

The question many in capital markets have been asking since the GSEs were put into conservatorship is this: Without Fannie, Freddie, or the Fed, who will buy the agency MBS? Today we are seeing this […]

Copyright © 2025 | MH Magazine WordPress Theme by MH Themes