I referenced in my last opinion piece in Housing Wire that the Urban Institute publishes a “monthly chart book” that is packed full of relevant data. This recent publication paints a clear picture as to why any Realtor or homebuilder should always include a nonbank lender in their referrals.

Before I open myself up to attacks here, I am using macro data from Urban Institute and there are certainly some banks who serve a broader swath of the market. But let’s start with the basics as to who really is expanding credit access in the market.

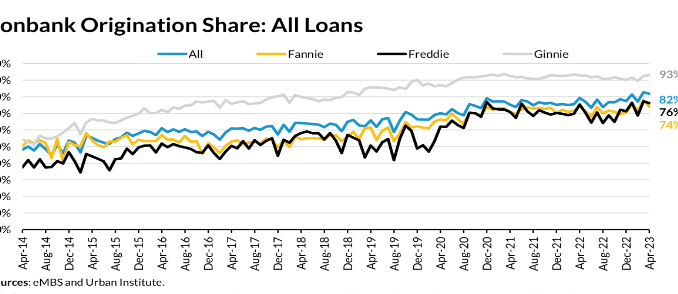

When looking at the nonbank share of all loans broken down by investor (Fannie, Freddie, and Ginnie Mae) the glaring data point that stands out is that nonbanks do well over 80% of all loans being made today. More importantly, when it comes to the Ginnie Mae programs, banks contribute only 7% of all the mortgages by the FHA, VA, and USDA. Seven percent is a glaring figure, especially when you look at the dynamics shaping the housing market.

Source: Urban Institute

The reason why this stands out is that the distribution of loans in the Ginnie Mae programs has the highest concentration of first-time homebuyers and the largest percentage of minorities. In the FHA program alone, 46.3% of all loans are to Hispanic and Black borrowers and with over 80% of all FHA’s purchase transactions going to first-time homebuyers, the fact that banks only do 7% of these loans is extraordinary.

Why does this all matter? Because the key regulators in Washington spend a lot of their time ingratiating themselves to the banking industry and lamenting about nonbanks. As Chris Whalen articulated in his recent op-ed, “Consumer Financial Protection Bureau head Rohit Chopra said in May that ‘a major disruption or failure of a large mortgage servicer really gives me a nightmare.’ He made these intemperate comments during CBA Live 2023, a conference hosted by the Consumer Bankers Association.”

The fact that regulators spend time “biting the hand that feeds them,” my reference to the fact that it is the nonbanks providing support for the constituency that this administration should care about and certainly not the audience at a CBA conference, is pretty alarming.

As Whalen goes on to highlight, “Chopra’s focus is political rather than on any real threat. But of course, progressive solutions require problems. Three large and mismanaged depositories failed in the first quarter of 2023, yet progressive partisans like Chopra, Treasury Secretary Janet Yellen, and Federal Housing Finance Agency head Sandra Thompson ignore the public record and continue to fret about nonexistent risk of contagion from mortgage servicers.”

I have taken a lot of negative feedback from many who are connected to the current administration about my criticism of things like LLPA fee changes. But in a similar context as Whalen, I am tiring of the politics of an administration and its regulators who focus their time on trying to reign in the independent mortgage banks (IMBs) — the very set of institutions that are responsible for ensuring that access to credit remains for American families who might otherwise be shut out of the market.

One might ask, why do IMBs do so much better here in advancing credit availability? I think it comes down to a core principal: IMBs only do mortgages. Unlike banks, they don’t do auto loans, credit cards, student loans, business lending, lines of credit and more. Banks don’t need to expand their mortgage lending businesses. In fact, the trend has been to retreat from mortgages, not embrace this segment further.

Just look at the data. When it comes to credit (FICO) scores, IMBs are significantly more aggressive. And since credit scores are lower for first-time homebuyers and trend lower in most minority segments, the IMBs naturally prevail as the best option for the homebuyer.

Or look at this data on DTI (debt to income ratio). The spread between median bank DTIs versus nonbanks in the Ginnie Mae program is significant and, frankly, will affect those on the margin of access to homeownership in a significant way.

The fact that banks are only 7% of all Ginnie Mae lending is not by accident. The reality is that they have systematically walked away from any element of mortgage lending that seems to be of greater risk. It’s frankly why companies like Wells Fargo today are a shadow of the mega-market dominators that they once were.

Whalen perhaps said it best stating, “More than any real-world problem posed by IMBs, it is the government in all of its manifestations that poses a significant risk to the world of mortgage finance and the housing sector more generally. Washington regulatory agencies seek to stifle the markets, limit liquidity and impose additional capital rules, strictures that must inevitably reduce economic growth and access to affordable housing.”

We have a labyrinth of federal regulators who failed to see how the significant rise in banks’ cost of funds, driven by the actions of the Federal Reserve, might push some banks into negative basis territory. This scenario, where they were paying depositors more than they were earning on their unhedged assets, put them out of business. And the regulators missed all of this. In all of their angst and speech-making about the risks of nonbanks, they simply overlooked three of the most expensive failures in banking history.

As I write this, I know that I too was once part of the arrogance of an administration that lectured and directed more than it listened at times. But today we face too many risks. Whalen clearly articulates how the GSEs are being directed down a path that will only decrease their relevance over time if left unchecked.

But perhaps the core message here is this: If I were a Realtor or homebuilder, I would make sure that my potential buyers, especially my first-time homebuyers, were in conversation with an IMB (or mortgage broker). If that simple step isn’t being done, then the access to credit challenges will likely only loom larger.

Remember, IMBs are not risk taking entities. They pass through the credit risk into government-backed lending institutions and they get paid a fee to service the loans for these government entities. We need regulators to stop speechmaking at banking conferences about risk here and instead applaud the critical role these companies perform.

More importantly, regulators should spend more time bolstering forms of liquidity to these entities. There are solutions that can help.

But really, the more time they spend politicizing the nonbank story, we risk more bank failures, which are truly the greater risk in the sector. Let’s applaud the IMBs for keeping the doors to homeownership open. And let’s demand that our regulators stop using political platforms to distort others’ views while not focusing on their primary responsibilities.

Accountability will only exist when stakeholders demand it.

David Stevens has held various positions in real estate finance, including serving as senior vice president of single family at Freddie Mac, executive vice president at Wells Fargo Home Mortgage, assistant secretary of Housing and FHA Commissioner, and CEO of the Mortgage Bankers Association.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

Dave Stevens at dave@davidhstevens.com

To contact the editor responsible for this story:

Sarah Wheeler at sarah@hwmedia.com