Inflation was running over 9% last year and the headline inflation growth rate has cooled off a lot recently. Does this mean the Federal Reserve will pivot soon to prevent a recession? I don’t believe they will, but the growth rate of headline inflation falling is good enough for them to pause rate hikes tomorrow.

The core aspect of inflation is taking time to head lower, and this is the part of the inflation picture that the Fed cares most about. As shown below, headline inflation has had a noticeable move lower as energy prices have been trending downward after the spike at the start of the Russian invasion of Ukraine.

This downtrend in inflation has been anticipated, so it’s no surprise that the growth rate is cooling off with energy prices falling.

The chart below shows the CPI headline versus core inflation data. Shelter inflation is finally fading but the data really lags. Used car prices have slowed down recently but that didn’t show up in today’s report, which means it will help core inflation data in the upcoming months. So, core inflation has two categories that will slow down in the near future between shelter and used car prices.

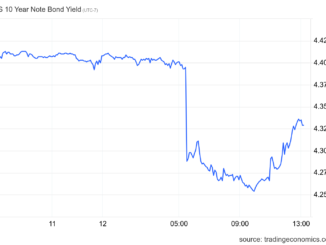

The bond market has had a wild day so far after this report was released. Due to the debt ceiling fiasco we have some abnormal market realities that can cause havoc in the bond market, which explains why yields are rising today. For the most part, everyone knows that the inflation growth rate is slowing down, but we are far from the low inflation growth rate data we saw from 2000-2019.

What does this mean for mortgage rates? My 2023 forecast for the bond market was a range between 3.21%-4.25% on the 10-year yield, and assuming the spreads were bad, mortgage rates between 5.75% and -7.25%. So far this year, this has been the case.

However, the spreads have worsened since the banking crisis started, which was the new variable in the mix for 2023. The banking crisis is the biggest issue for mortgage rates because it is keeping rates higher than they should be, even though I assumed the spreads would be bad this year. Below, the sharp V-shape moved higher after the banking crisis started.

Since my focus has been more on the labor market this year, the growth rate of inflation falling was already factored into my bond yield range for 2023. So, the fact that the growth rate is cooling but the labor market has been firm explains why mortgage rates aren’t lower today.

If labor gets weaker, meaning jobless claims break over 323,000 on the four-week moving average, that was my best case for the 10-year yield to break under 3.21% and send mortgage rates lower. So far, the labor market has held up. This explains why the 10-year yield is higher than some would have imagined, with the inflation growth rate cooling off on the headline portion of the CPI report.

I don’t see anything in the data that warrants inflation growing faster unless we get a supply shock somewhere.

Energy benefits will fade

A big reason headline inflation has cooled down is that energy and gas prices have gone down a lot year over year. The 2022 Russian invasion of Ukraine sent oil and wheat prices skyrocketing, but over time, this has faded. Unless the recession starts soon, energy is finding a bottom-end range between $67-$72 a barrel.

As we can see in the CPI report, the energy aspect of the CPI report is seeing a significant cool-off. This, over time, will fade unless we get another leg lower.

Of course, energy prices fading means more money in the hands of consumers; it’s a net tax cut if you look at it that way. Also, since most Americans still drive at some point in the month, high energy prices impact the country’s mood. Now that prices have come down from their high, it’s been a net benefit for consumption.

The shelter inflation slowdown tour has started

Core inflation is what the Fed cares about, and they have stated that they’re looking at core inflation, excluding shelter. However, since it’s 44.4% of CPI, they can’t ignore the most significant component of inflation falling and stay hawkish.

It’s well-documented that rent inflation lags badly. In fact, it lags so badly that the Fed created its own inflation index to account for the lag. If we had more fluid CPI reporting, the growth rate of core inflation would be much lower today. I believe that everyone understands this concept, including the bond market. This is why the 10-year yield peaked at 4.25% last year, as it never bought into the story of 1970s-style rent inflation, as we see below.

I talked about this lag last year on CNBC, and the reality is that the rent inflation growth rate has been fading faster than the CPI data can account for.

What’s next

While the headline inflation has cooled down a lot, the core CPI inflation data has been slow to move lower. The core CPI aspect will decrease with shelter inflation cooling off over the next 12 months. If we get a job-loss recession as the Federal Reserve wants to fight inflation, then the growth rate of inflation can fall more as the labor supply grows and wage growth cools down.

Tomorrow we will have the result of the Federal Reserve’s two-day meeting, and they will pause rate hikes, especially after seeing this report showing that inflation is heading in the right direction.

However, as I have stressed, the Fed wants to attack labor and wages, which is their goal until it’s accomplished. In their minds, to prevent a 1970s-style inflation run, people need to lose their jobs because wage growth could keep inflation going stronger than anticipated. However, wage growth has been cooling for 18 months now, and the fear of wages spiraling out of control upward was a silly notion.

We have one more inflation report for this week, but all eyes are on the Fed tomorrow. Try not to focus on the pause in rate hikes. Try to focus on the language of their statements, especially when we see the live questions and answers with Chairmen Powell.