The existing home sales market is a face on a milk carton, and homebuilders are salivating at the opportunity to meet strong consumer demand. So why aren’t they?

New data from the U.S. Census Bureau speaks to the growing strength of the new home market, which stands in stark contrast to the moribund re-sale market. May’s housing starts rate was actually the highest since April 2022, which was then the highest since 2006.

Let’s dive in a little deeper. Get a load of these figures:

Privately‐owned housing starts in May were at a seasonally adjusted annual rate of 1.63 million, 21.7% above the revised April estimate of 1.34 million and 5.7% above the May 2022 rate of 1.54 million. The 291,000-unit monthly increase in starts was the most since January 1990, and the 21.7% rise was the largest percentage gain since October 2016.

Single‐family housing starts in May were at a rate of 997,000; 18.5% above the revised April figure of 841,000. The May rate for units in buildings with five units or more was 624,000. Interestingly, the share of single-family housing starts dropped to 61.5% of total housing starts over the past 12 months through May, the lowest share since 1986. The share of multifamily starts in buildings of 5+ units rose to 38.7%, the highest share since 1974.

Privately‐owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 1.491 million. This is 5.2% above the revised April rate of 1.41 million but is 12.7% below the May 2022 rate of 1.7 million. Single‐family authorizations in May were at a rate of 897,000; this is 4.8% above the revised April figure of 856,000. Authorizations of units in buildings with five units or more were at a rate of 542,000 in May.

Currently there are 695,000 single-family units under construction, which is actually 136,000 units below the peak in May 2022. And there are currently 994,000 multifamily units under construction, the highest level since 1973.

Homebuilders are now completing more single-family homes than they are starting, but starting more multifamily units than they are completing. The latter is likely due in part to construction delays and stalled projects, but the permitting data suggests builders in single-family and multifamily see different levels of opportunity.

The industry probably won’t hit the extreme highs of 2022 in terms of housing starts, but multifamily is still booming. We’ll likely see a lot of units delivered later this year and into next year, though I would keep an eye on banks pulling back on construction financing, which could sharply reduce completions.

Single-family construction deliveries, meanwhile, will likely be more muted. That’s despite various housing economists projecting existing home sales to fall about 20% in May. (We’ll know more when the existing home sales report is released on Thursday and new home sales next week.)

In other words, the multifamily deliveries will likely relieve pressure in the form of rents and help with overall supply, but the inventory deliveries likely won’t do much for the sales market. And we still have a long way to go in meeting overall housing demand.

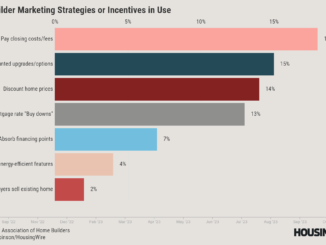

Homebuilders today have a big advantage. Their products now comprise about 30% of the sales market — nearly three times the normal rate — and that’s because there’s so few total homes. Cancellation rates among national homebuilders are now down to about 9% (you may recall that KB Homes reported a cancellation rate of 68% in Q4 2022) and the vast majority of them can throw major incentives like mortgage rate buydowns at choice-restricted homebuyers. The few existing homeowner sellers aren’t incentivized to negotiate much, and there’s no reason to think they will for a long while.

So why aren’t builders going even harder, particularly with single-family homes? The answer won’t shock you: beyond their own specific profit incentives, in much of America, it is simply way too hard to build a home, and way too expensive. Zoning restrictions, inane building code regulations/restrictions, NIMBYs and the weaponization of environmental laws have resulted in housing death by a thousand cuts. A nation doesn’t end up with a shortage of 6 million-plus homes by accident.

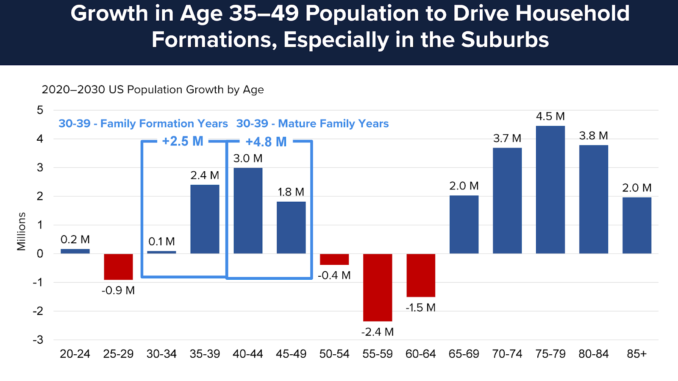

We’ve talked before about the regional disparities in inventory – the demographic trends for housing look strong through at least 2030, but also look at where we are building, courtesy of John Burns Research & Consulting.

State legislatures and governors on the coasts have failed to address their respective housing crises, particularly by allowing suburban towns to block housing. They desperately need to institute reforms and override local control.

It will certainly be an uphill battle. While homebuilders stick shovels in the suburbs and exurbs of the Sunbelt, few new homes are being built in the Northeast or on the West Coast.

New York Gov. Kathy Hochul failed to get her YIMBY-friendly housing package through the legislature, though the sought reforms — which include mandating housing in the suburbs by overriding local zoning rules — are hopefully a future reference point for housing policy changes. And in California, Gov. Gavin Newsom in late September signed into law a major reform to homebuilding in the state, which will override local zoning codes to allow more affordable housing units to be built on commercially zoned land. He’s also looking to limit the procedural scope of the environmental law known as CEQA, which has been used to kill all sorts of projects in California. But under Newsom, California has built roughly 500,000 total housing units in six years. In a healthier market with fewer constraints, that figure would be closer to 2 million.

With arguably fewer incentives than ever for existing homeowners to sell, homebuilders must be able to maximize their productivity and build where demand is strong. Permit reform and policy changes alone won’t be enough to create millions of new housing units, but you gotta start somewhere.

Share your thoughts on permit reform and housing policies that would result in more housing by emailing me at james@hwmedia.com.

In our weekly DataDigest newsletter, HW Media Managing Editor James Kleimann breaks down the biggest stories in housing through a data lens. Sign up here! Have a subject in mind? Email him at james@hwmedia.com.