The easy choices have already been made: the low performers left many moons ago, the travel budgets have been slashed, and struggling branches have been sold to competitors or unceremoniously closed.

For the mortgage industry, more often it’s about making the very hard choices these days – exiting a channel, deciding which star performer to let go, etc. After all, the average retail lender lost nearly $2,000 per loan in the first quarter, and I expect losses to be similar in Q2 and elevated in Q3.

One consequence of mortgage lenders – and LOs, for that matter – being on the ropes is the lack of investment back into their business. I get it! Money’s tight and lenders are plugging holes in the boat, not buying a new engine.

In our quarterly HousingWire LenderPulse survey, we asked retail loan officers, branch managers, C-suite execs, brokers and others how they feel about the market, where they expect rates to be in Q3, and what they’re doing to reduce costs.

Interestingly, 57% of the 166 respondents said they do not plan to invest in tech, services or solutions in the third quarter. The rest of the surveyed pros were evaluating or still planning to purchase lead generation services and keep loan originations systems, customer relationship management (CRM) platforms and services that maximize repeat and referral business for lenders.

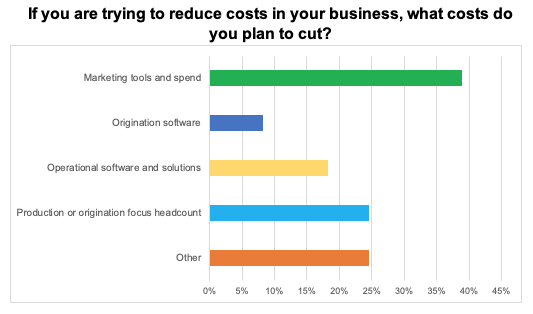

While the respondents were split as to whether to invest or hold spending money in tech, when asked about what business cost reductions they plan to make in the future, 39% of surveyed mortgage professionals pointed to cutting their marketing spend/tools. Just under 25% of the respondents said they would cut down on production or origination-focused headcount, followed by operational software and solutions (18%); and originations software (8%). Other responses included cutting down excessive incentives, business trips, open houses and sponsorships.

Mortgage is famously an unforgiving, low-margin business. The lenders and LOs that saved their cash from the pandemic unicorn years and have been disciplined about maintaining their marketing strategy and investing in technology should see outsized returns in the years to come.

After all, as the famous Warren Buffett saying goes, “Only when the tide goes out do you learn who’s been swimming naked.”

James Kleimann

Managing Editor, HW Media

In our weekly DataDigest newsletter, HW Media Managing Editor James Kleimann breaks down the biggest stories in housing through a data lens. Sign up here! Have a subject in mind? Email him at [email protected].