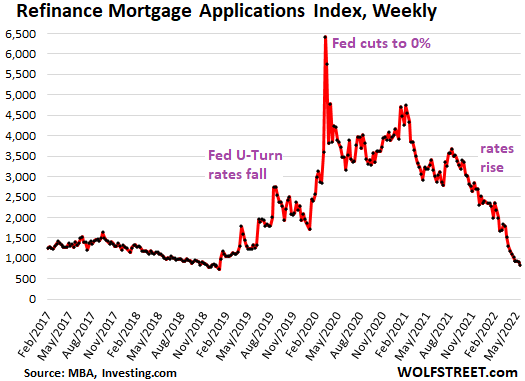

The real estate assets of securities firms here have plunged in value over the past year amid continued market uncertainties caused by a hawkish cycle of rate hikes, data showed.

According to data compiled by the Korea Financial Investment Association (KOFIA), the property assets of seven securities firms out of the top 10 lost value as of the end of the first quarter, from a year earlier. They include top-ranking brokerage houses ― such as Mirae Asset Securities, Meritz Securities and Korea Investment & Securities.

Shinhan Securities topped the list in terms of the decline in property investment value. The company invested in real estate worth 94.9 billion won ($73.47 million) as of the end of March 2022, but the value fell by more than 80 percent down to 12.6 billion the following year, following the sale of its headquarters on Yeouido in Seoul.

Other brokerages faced a similar situation after the real estate market entered a clear path of downturn last year following a consecutive set of key rate hikes by the U.S. Federal Reserve and the Bank of Korea.

The figure for KB Securities also dropped 15 percent to 14.6 billion won during the same period. Korea Investment & Securities was also hit harder by the market doldrums with a drop of 29 percent.

But some others ― such as NH Investment & Securities and Kiwoom Securities ― achieved slight gains in their investment properties over the same period.

Loading…

Source: www.koreatimes.co.kr

ENB

Sandstone Group