While we already know that according to much-delayed CPI data, annual shelter inflation has just peaked at just under 9% annual growth, and will now be trending lower for the next 18-24 months.

But while the roughly 12 month delayed CPI data brought some good news, there was much better news in the latest monthly Rental Market Tracker from Redfin, which unlike the CPI, provides a real-time snapshot of the rental market. What it shows is that not only have rents peaked, but the median U.S. asking rent is about to turn negative on an annual basis, having risen just 0.3% year over year to $1,967 in April. That’s the 11th-consecutive month of slowing growth, and is the first (effectively) unchanged print since the covid crash in March 2020. It compares with a revised increase of 1.4% one month earlier and a 16% increase one year earlier. More importantly, extending the current trendline suggests that rents will now decline on an annual basis for the foreseeable future.

On a month-over-month basis, the median asking rent fell 0.2%, which is notable because rents typically rise at this time of year.

According to Redfin, the slowdown in rent growth is mostly due to a supply glut in the form of an expanding pool of rentals to choose from: “The homebuilding boom over the last decade-and-a-half has increased the number of new rentals on the market, and landlords are now grappling with rising vacancies.”

Completed residential projects in buildings with five or more units jumped 60% year over year on a seasonally-adjusted basis to 484,000in March–the most recent month for which data is available. There are only three other instances since the 1980s when completions were higher.

Meanwhile, the rental vacancy rate ticked up to 6.4% in the first quarter–the highest level in two years.

“The balance of power in the rental market is tipping back in tenants’ favor as supply catches up with demand. That’s easing affordability challenges and giving renters a little wiggle room to negotiate in some areas,” said Redfin Deputy Chief Economist Taylor Marr. “The market has become more balanced, but the scales could tip back in favor of landlords if homebuilders pump the brakes on new construction in response to slowing rent growth.”

Rent growth is also decelerating because many people are opting to stay put. Fewer people are moving due to economic uncertainty, slowing household formation, still-high rental costs in many markets, and the rising cost of other goods and services due to inflation.

Where rents are falling the fastest.

In Austin, TX, the median asking rent fell 14.3% year over year in April–the largest decrease among the major U.S. metropolitan areas Redfin analyzed. Next came Phoenix (-9.6%), Las Vegas (-7.1%), Oklahoma City, OK (-6.4%) and Chicago (-6%). All but two of the 10 metros with the largest declines are in Sun Belt states.

Austin, TX (-14.3%)Phoenix, AZ (-9.6%)Las Vegas, NV (-7.1%)Oklahoma City, OK (-6.4%)Chicago, IL (-6%)Birmingham, AL (-4.5%)Sacramento, CA (-4%)Memphis, TN (-3.6%)Seattle, WA (-3.2%)Dallas, TX (-2.8%)

The Sun Belt exploded in popularity during the pandemic as scores of remote workers moved there in search of relatively affordable housing and warm weather. Rents surged and are now coming back down to earth as supply catches up to demand. Much of the nation’s homebuilding in recent years has taken place in the Sun Belt. Phoenix and Austin both ranked in the top five metros with the highest number of multifamily building permits in March.

“A lot of renters took on roommates or moved in with family when rents increased dramatically during the pandemic, which left more rentals and fewer renters needing places,” said Van Welborn, a Redfin Premier real estate agent in Phoenix. “Landlords who increased prices too quickly are now feeling the impact as the market calms and rents decrease to more reasonable levels.”

Welborn said the short-term rental market is also cooling due to an oversaturation of Airbnbs and new restrictions on hosts. The silver lining for landlords in Phoenix is that seasonal renters will still pay a premium in the winter, and the local job market is holding up–especially with a large new semiconductor plant moving in.

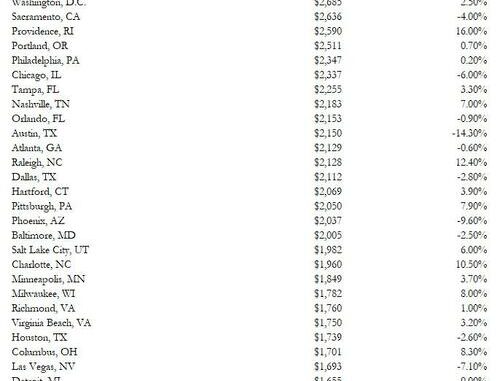

Finally, here is a breakdown of Median Asking Rents by Metro Area in April 2023

Loading…

Source: Energy News Beat

Sandstone Group