The U.S. Federal Reserve on Wednesday raised its benchmark interest rate by 0.25 percentage point, pressing on with its aggressive monetary tightening campaign to curb decades-high inflation despite further financial turmoil following the collapse of California-based First Republic Bank.

Another increase brings the federal funds rate, which banks charge each other for overnight borrowing, to a new target range of 5 to 5.25 percent.

The 10th consecutive hike since March 2022 was announced after a two-day meeting of the policy-setting Federal Open Market Committee, as it attempts a delicate balancing act between lowering high prices and dodging a recession.

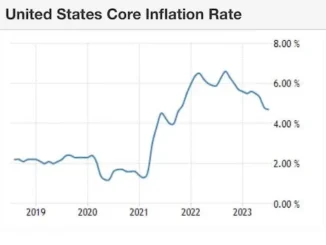

The committee said the latest decision was necessary to achieve its goal of seeing a 2 percent rate of inflation over the longer run, but dropped the expression used last time that it “anticipates” additional policy firming may be appropriate.

In its statement, the FOMC reiterated the previous language in affirming it “would be prepared to adjust the stance of monetary policy as appropriate if risks emerge.”

It also said the country’s “banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation.”

When it last raised the interest rate, also by 0.25 percentage point, in March, global financial markets were reeling from the demise of Silicon Valley Bank, a major U.S. lender for startups, and Signature Bank, a New York-based lender that had deep connections with the cryptocurrency industry.

Amid lingering contagion fears and worries over tougher credit conditions, U.S. regulators on Monday seized control of First Republic, making it the second-largest bank to fail in U.S. history.

The earlier pair of bank failures had rocked public trust in regional lenders, causing First Republic, a midsize bank which specialized in private banking for wealthier customers, to suffer a rapid loss of more than $100 billion in deposits in the weeks leading up to its collapse.

Source: news.abs-cbn.com

ENB

Sandstone Group