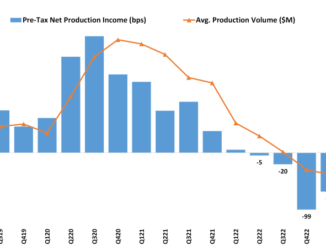

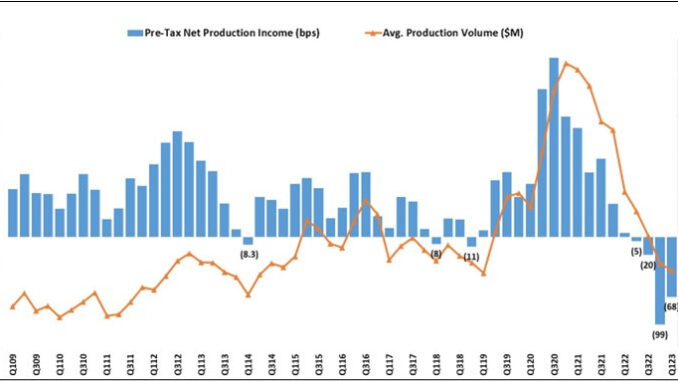

Despite a marked improvement from the fourth quarter of 2022, independent mortgage banks (IMBs) and mortgage subsidiaries of chartered banks still lost a mountain of money in the first quarter.

On average, IMBs reported a net loss of $1,972 on each loan originated from January to March, a 35% improvement from the reported loss of $2,812 per loan in the fourth quarter of 2022, according to the Mortgage Bankers Association (MBA).

A net production loss of 68 basis points in the first quarter is a sober reminder that conditions remain extraordinarily challenging for the industry, even if losses narrowed from the record 99 bps loss recorded in Q4.

Chart courtesy of the Mortgage Bankers Association

The industry has experienced four consecutive quarters of production losses and nine consecutive quarters of volume declines, according to Marina Walsh, the MBA’s vice president of industry analysis.

The average production volume was $398 million per company in the first quarter, down from $436 million per company in the fourth quarter of 2022. The volume by count per company averaged 1,264 loans, a drop from 1,395 loans during the same period.

All in all, including both the production and servicing business lines, 32% of companies were profitable in Q1, up from 25% in the last quarter of 2022.

Another silver lining for IMBs was improved production revenue of 40 bps in the first quarter from the previous quarter.

However, costs continued to escalate with the further drop in volume and reached a study high of $13,171 per loan despite substantial personnel reductions, Walsh noted.

Loan production expenses averaged $7,172 per loan from the third quarter of 2008 to the last quarter of 2022. The average number of production employees per company also declined to 374 between January and March from 413 from the previous quarter.

Servicing operating income — which excludes MSR amortization, gains or loss in the valuation of servicing rights net of hedging gains or losses, and gains or losses on the bulk sale of MSRs — slightly declined to $102 per loan in the first quarter from the previous quarter’s $104.

The sale of MSRs does not directly impact earnings as a revenue stream, but the conversion of MSRs into cash via sales deals bolsters a lender’s cash flow and overall liquidity.

It’s not all bad news, however. The MBA expects mortgage origination volume for one- to four-family homes to post $461 billion in Q2, a rise from $333 billion in Q1 2023, according to its latest forecast.

The MBA also projected the 30-year fixed mortgage rate to trend down to an average of 6.2% in the second quarter, ultimately declining to 5.5% by the fourth quarter of 2023.