There is the possibility of a doom loop between Small US banks and commercial real estate. The scenario looks like this:

- Small banks in the US hold over 70% of commercial real estate loans.

- Prices for most types of commercial real estate in most localities are falling; in some major cities it is estimated that 90% of properties are “under water” (e.g. debt on the properties exceeds the value of the property).

- A flight of deposits from small banks to large banks and money market funds decreases the capital available for real estate loans.

- The tighter loan market, including higher interest rates, is also making it more difficult to refinance real estate.

- In the event current owners of commercial real estate are unable to refinance, a wave of defaults may ensue, leading to further decreases in commercial real estate prices and default of small banks – a negative spiral or doom loop.

Now that you have the big picture, I will provide more colour and context on each of the above points.

- Small banks in commercial real estate

Small and mid-sized banks (e.g. all except the top 25 banks) hold over 67% of commercial real estate loans. Commercial real estate constitutes some 43% of small bank loans in the US.

- Commercial real estate prices are falling, properties are “under water”

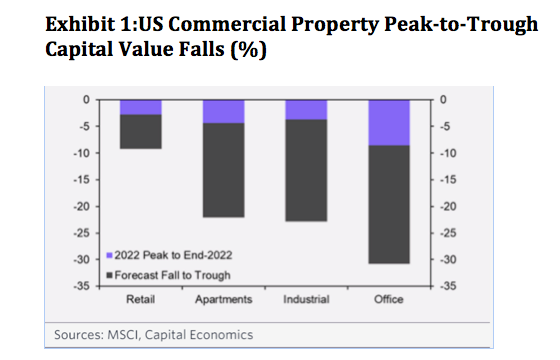

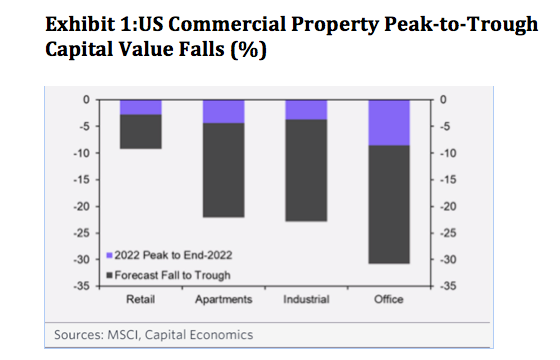

Commercial real estate prices have fallen about 5% since their peak in mid-2022, and are forecast to fall 15-20% further as the cycle plays out:

The above chart is based on US national averages. In cities hit by particularly high office vacancy rates (e.g. Los Angeles) the situation is much worse. According to Colliers, Los Angeles office towers carry an average of over $230 debt per square foot, while the market value is $154/sq ft. Brookfield, the city’s biggest commercial landlord, defaulted on over $1bn in loans this year.

In the US, it is estimated that there is approximately $1.5 trillion in commercial real estate loans coming due by the end of 2025 with the potential of being under water. This will create distress sales and further depress real estate prices.

- Flight of deposits from small banks

In the second half of March 2023 alone, some $230bn in deposits was withdrawn from US small banks. While the situation since then has more or less stabilised, this withdrawal leaves a gaping hole in the ability of small banks to finance and refinance commercial real estate. Further flights of capital remain possible. It is understandable that small banks have become so much more cautious on commercial real estate lending.

While increasing interest rates have caused bond values to fall, under current regulations banks do not need to write these down to market value if held to maturity. Hence although healthy on paper, according to Professor Amit Seru of Stanford University, almost half of America’s 4,800 banks have de facto burned through their capital buffers.

Isn’t it ironic that US Treasuries, meant to be the pillar of stability of the global financial system, are now its Achilles heel? All because the Fed acted irresponsibly in artificially depressing interest rates for years, then slammed on the brakes with the fastest interest rate hikes in US history.

- Tighter loan market

The prime rate – the rate which banks charge to their most creditworthy customers – has shot up from just over 3% at the end of 2020 to just over 8% as of May 2023. Interest rate expenses for those loans that are about to renew or variable rate mortgages have almost tripled over three years. Many bankers talk of tighter terms and conditions as well (coverage ratios, percentage of collateral, etc.)

An important source of liquidity for mortgage markets – Commercial Mortgage-Backed Securities (CMBS), where banks securitise and resell bundles of mortgages – has virtually seized up. As of March 2023, the volume of CMBS lending declined by 85% compared to a year ago, further tightening the loan market.

- Negative Spiral

The above amply demonstrates the potential for a doom loop; this risk further increases in the event of a recession. At highest risk will be those properties with floating rate mortgages, or mortgages that will expire soon. There is also the potential for contagion. A foreseeable contagion would be towards municipal finance, as the amount of property tax paid by owners of commercial real estate could drop dramatically.

According to Fed Chair Powell: “We’re well aware of the concentrations … in commercial real estate…the banking system is strong, it is sound, it is resilient, it’s well-capitalised.” Is he talking of the same banking system?

Professor Seru’s interpretation is unfortunately perhaps more credible: “A lot of the US banking system is potentially insolvent.”

Source: intellinews.com

ENB

Sandstone Group