The debt ceiling deal struck by President Joe Biden and House Speaker Kevin McCarthy on Saturday represents momentary relief for the mortgage market, as it reduces the chances of a federal government default. But that’s just the first step in an ongoing effort to avoid the chaos.

The deal has to receive Congressional approval before the U.S. Department of the Treasury runs out of cash by Monday. And, if approved, it does not solve the high debt level problem, which means that other risks, such as a U.S. debt downgrade, are still on the horizon.

Regarding the mortgage market, on the one hand, the debt-ceiling agreement put an end to the recent mortgage rates’ upward trend to the highest level in two months. On the other hand, it resumes student debt payments, affecting potential homebuyers.

According to Mortgage News Daily, the conventional loan 30-year fixed rate reached the 7.14% level on Friday amid the debt-ceiling drama. After the tentative deal announcement by the leaders on Tuesday, it went down to 7.02%.

“In the short term, we watched mortgage rates over the course of the past 10 days go up significantly, so a fair amount of damage has already been done,” Melissa Cohn, regional vice president of William Raveis Mortgage, said in an interview.

Cohn added: “And now it’s a question of whether or not the debt ceiling agreement that McCarthy and Biden came to this weekend can get voted upon. I wouldn’t say it’s a done deal. There are a lot of people that disagree about parts of it and are saying that they won’t vote for it. Every day that goes on, it’s a bad day.”

Analysts at Goldman Sachs also recognize the challenges related to Congressional approval. The House is slated to vote on the agreement on Wednesday and the Senate is scheduled for Friday, though procedural delays could push the vote into the weekend.

“Reaching a deal between leaders has been the highest hurdle and this agreement eliminates most of the uncertainty regarding the impending debt limit deadline, though the legislation must still pass the House and Senate,” Goldman Sachs analysts wrote in a report. “Regardless, the chances that Congress allows the June 5 deadline to pass without action now appear very low.”

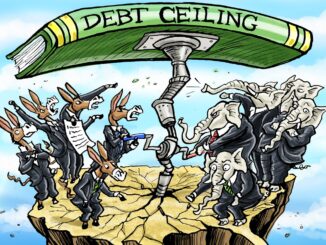

What’s in the agreement?

Biden and McCarthy’s “Fiscal Responsibility Act” suspends the $31.4 trillion U.S. debt limit until January 2025, with the ceiling set at whatever level it reaches when the suspension ends. In practice, it pushes the problem to after the next presidential election, economists say.

In turn, non-defense spending will be capped at current levels for 2024 and will rise by 1% in 2025. The spending deal looks likely to reduce spending by 0.1-0.2% of gross domestic product year over year in 2024 and 2025, compared with a baseline in which funding grows with inflation, the Goldman Sachs analysts wrote.

The deal also makes several policy changes. It requires some older Americans who receive food stamps to find jobs; halts funds to hire new Internal Revenue Service agents; brings new measures to get energy projects approved more quickly; and saves billions of dollars in unspent COVID relief, among other things.

But one of the bill’s topics has the potential to affect the mortgage market indirectly: the end of the student debt payments moratorium by the end of August.

The Fiscal Responsibility Act, as it is now, prohibits the U.S. Secretary of Education from using any authority to suspend payments and waive interest. Meanwhile, Biden’s student loan forgiveness plan, which forgives $10,000 to $20,000 in student loan debt for most borrowers, is expected to be decided by the Supreme Court.

“All this year, because of the anticipation that the student loan payments were going to resume in the fall, banks had been including that debt when qualifying borrowers. So I don’t think it has a big change,” Cohn said.

“I mean, obviously, if it were to get student debt payments deferred for a longer time or forgiven, that would have perhaps a positive impact. If you don’t have to make that payment or the debt is forgiven, you have more buying power. It’s especially important in a higher rate environment,” Cohn added.

Pressure from different sources

The agreement brings some relief to the mortgage market, but there is still pressure from different sources. There’s still resilient inflation running at double the target and the Federal Reserve’s (Fed) ongoing tightening monetary policy. In addition, a banking crisis is still haunting the financial markets.

Logan Mohtashami, the lead analyst at HousingWire, said, “The debt ceiling issue, for now, is over unless something unforeseen happens, but the banking crisis and the mortgage stress are still here.”

“We might get some short-term reprieve in bond yields and mortgage stress [resulting from the debt agreement],” Mohtashami said. “However, the spreads between the 10-year yield and 30-year mortgage rates have worsened since the banking crisis started. It will be critical to see how the bond market and mortgage spreads act this week.”

Scott Olson, executive director at Community Home Lenders of America (CHLA), recognizes no direct connection regarding policies in the Fiscal Responsibility Act that affect the mortgage industry.

“But mortgage rates have been creeping up in recent weeks because of uncertainties, so an agreement that brings some deficit reduction and removes this uncertainty over default can only be a positive development for the mortgage industry,” Olson said in an interview.

The agreement represents a relief from the fiscal policy side. However, there are still pressures from the monetary policy side. “Regarding the Fed’s monetary policy, inflation seems to be negative and naggingly persistent,” Olson said.

The Fed is set to meet on June 13 and 14 to decide on the new federal funds rate.