Just when I thought days on market were returning to normal, that number for existing homes fell back down to 22 days. Why is this so important to me? If the days on the market are at a teenager level or even lower, it’s never a good sign for the housing market. I would say it’s savagely unhealthy to have that level and even though we’re not there yet, we are dangerously close.

To even get close to that level, we either have a massive housing credit boom, which will eventually turn into a bust, or we have a shortage of homes, meaning too many people are chasing too few homes.

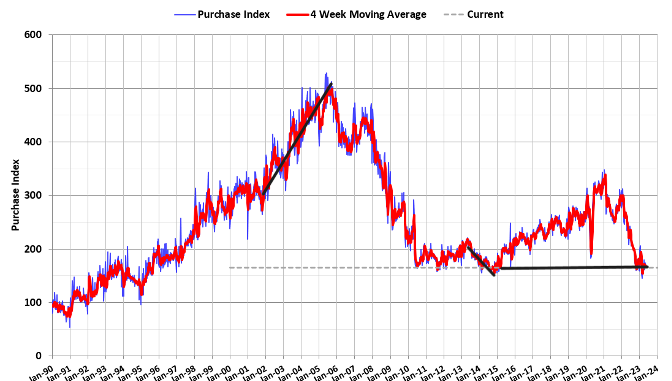

We don’t have a massive credit boom as purchase application data is at historical lows; we haven’t had the same run-up in credit as we saw from 2002-2005. This is why I always draw the black line on the chart below — to show people that we haven’t had a credit boom for many years. If we had a massive credit boom-to-bust, inventory would have skyrocketed in 2022.

Instead, active listings are near all-time lows, which wasn’t the case from 2012-2019. This is why the days on the market are so low historically after 2020.

After the most significant home sales collapse recorded in U.S. history in 2022 and stabilization in sales data in 2023, total active listing NAR stands at 1.04 million, up from 1.03 million last year. The historical norm is between 2-2.5 million. In 2007, for context, we were a tad above 4 million.

NAR Total Inventory Data going back to 1982.

In Thursday’s existing home sales report, the data line I once loved turned on me again. Now I have to contemplate that the days on market can return to a teenager level even with home sales trending at a 10-year low.

From NAR: First-time buyers were responsible for 29% of sales in April; Individual investors purchased 17% of homes; All-cash sales accounted for 28% of transactions; Distressed sales represented 1% of sales; Properties typically remained on the market for 22 days.

As you can see in the chart above, days on the market falling isn’t a good thing, but it’s the reality of the world we live in after 2010. The U.S. housing market inventory channels have changed due to how the U.S. housing credit channels have changed. This is not, nor can it ever be, like 2008. If it was like 2008, you’re about four to six years too early in 2023. You would need years of credit stress building up, as we saw in 2005-2008, all before the job loss recession data.

One of my themes for existing home sales has been that after a big bounce in one home sales report, we shouldn’t expect too much to happen. We had that bounce in the March report as we saw one of the most significant month-to-month sales reports ever recorded in U.S. history. However, after that bounce, I didn’t think we would see much growth because that was an abnormal event.

NAR: Total existing-home sales slid 3.4% from March to a seasonally adjusted annual rate of 4.28 million in April.

When we saw that first jump in home sales from 4 million to 4.55 million, it was a historically abnormal giant sales print month to month. This is the tricky part of reading high-velocity economic data; when data historically moves slowly month to month, you have an easier trend to navigate.

However, when you have a collapse like we did in 2022 and then purchase application data started to improve starting from Nov. 9, 2022, that was a setup for a giant one-month sales print, and after that we should be in a range between 4 million and 4.6 million. While purchase application data has had more positive prints than negative prints this year, there isn’t the real net volume growth this year to break above 4.6 million with duration or break under 4 million with duration.

Since purchase application is very seasonal, and that seasonality is almost done after May, we should now be watching mortgage rates. Mortgage rates moving up and down have moved the market. Currently, rates have been rising; we saw that impact in this week’s purchase application data report, which was down 4.8% weekly.

However, everything still looks right regarding the 10-year yield and mortgage rates. My 2023 forecast was based on where I believe the 10-year yield will range, between 3.21%-4.25%,and so far the range has stayed true. That range means mortgage rates will be between 5.75%-7.25%. If jobless claims break over 323,000 on the four-week moving average, the 10-year yield break should be under 3.21% and send mortgage rates lower. However, we aren’t close to breaking that level on jobless claims.

The recent banking crisis has put more pressure on the spreads, and the debt ceiling issues has put some market stress on shorter-duration bonds. We must watch this because mortgage rates in the 7% plus range have cooled the housing market noticeably last year and this year. Once rates moved from 5.99% to 7.10%, we saw three straight hardcore declines in the purchase application data.

One thing about all housing data going ahead, the year-over-year comps are going to get a lot easier because of the historic collapse in demand last year. This will occur in the second half of 2023 and get especially easy to see in the last two months of the year. So, when we see better year-over-year data in home sales and purchase application data, you need to put an asterisk on it and know this is primarily due to demand stabilizing and easier comps.

NAR: Year-over-year, sales slumped 23.2% (down from 5.57 million in April 2022).

All in all, the existing home sales report didn’t have too many surprises today, but a harsh reality is that because active listing growth is negative year to date, as we have shown in our weekly Housing Market Tracker, the days on the market are starting to fall again.

From NAR: “Roughly half of the country is experiencing price gains,” Yun noted. “Even in markets with lower prices, multiple-offer situations have returned in the spring buying season following the calmer winter market. Distressed & forced property sales are virtually nonexistent.”

For the rest of the year, it will all be about mortgage rates and that will be where the 10-year yield is going. Remember, higher rates impact the sales data just as much as lower mortgage rates have; this is why we keep track every week for you with the Housing Market Tracker.