It was a wild ride for the housing market last week! The 10-year yield rose noticeably, sending mortgage rates near 7% right in the heart of the spring selling season. New listings data fell, however, active inventory grew. And purchase apps had a weekly negative print, continuing the 2023 theme of higher rates impacting the data.

Here’s a quick rundown of the last week:

Total active listings grew by 3,809 weekly, but new listings are still trending at all-time lows.

Mortgage rates rose last week as we started the week at 6.55% but ended at 6.90%.

Purchase application data fell 4.8% weekly as the streak of higher rates impacting the weekly data continues.

Weekly housing inventory

They say slow and steady wins the race; well, for housing inventory in 2023, it’s been terribly slow this spring. How slow has the active listing growth been? Here is my crazy stat for the week: Last year at this time, the weekly active inventory grew by 25,542 in just one week. This year from the seasonal bottom, the total increase has only been 18,722.

Can anyone say savagely unhealthy? In my wildest dreams, I would have never thought this could happen being so close to June.

Weekly inventory change (May 5-12): Inventory rose from 420,381 to 424,190

Same week last year (May 6-13): Inventory rose from 312,857 to 338,399

The inventory bottom for 2022 was 240,194

The peak for 2023 so far is 472,680

For context, active listings for this week in 2015 were 1,108,932

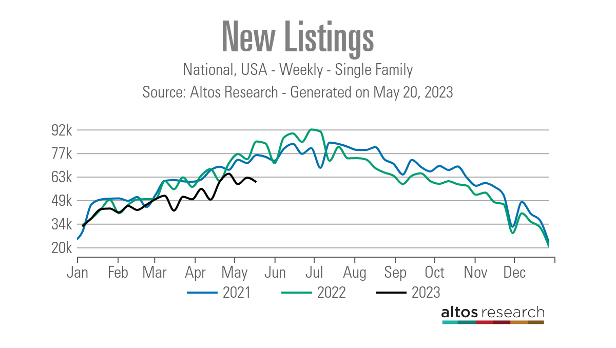

According to Altos Research, new listing data fell last week, and the year-over-year decline is very noticeable as we have been trending at all-time lows all year. However, at this time last year, we saw some new listings growth versus 2021 levels. In the second half of 2022, mortgage rates spiked toward 7.37%, and new listings started to trend negative as some people gave up listing their homes with rates so high.

Here is the new listings data for this week over the last several years:

2023: 59,651

2022: 84,298

2021: 76,051

And here’s the new listing data for the same week in more normal years to give some historical perspective:

2017: 89,411

2016: 90,048

2015: 90,323

The NAR data goes back decades and illustrates how hard it’s been to get the total active listings back to the historical range of 2 million to 2.5 million. The latest existing home sales report, which I wrote about here, showed the year-over-year growth went from 1.03 million to 1.04 million.

NAR: Total inventory:

The 10-year yield and mortgage rates

A crazy week in the 10-year yield shot mortgage rates higher. We have a lot of drama talking points with the debt ceiling issue, but the jobless claims data had a good report, reversing the big negative number in the previous week.

When I talk about mortgage rates, it’s really about where I feel the 10-year yield will go for the year. In my 2023 forecast, I said that if the economy stays firm, the 10-year yield range should be between 3.21% and 4.25%, equating to 5.75% to 7.25% mortgage rates.

Now if the economy gets weaker, meaning the labor market sees a noticeable rise in jobless claims, then the 10-year yield should break under 3.21%, going all the way to 2.72%. This would take mortgage rates under 6%, and if the spreads return to normal, this could even get us below 5% mortgage rates again.

However, on that front, jobless claims did have a good week, as they fell which is a positive sign for the labor market, not a negative.

From the St. Louis Fed: “Initial claims for unemployment insurance benefits declined 22,000 to 242,000 in the week ended May 13, bringing the four-week moving average down to 244,250.”

Purchase application data

The housing market shifted significantly when mortgage rates peaked late year and started to fall. During that time, purchase applications had more positive than negative prints, stabilizing demand. As we can see below, our waterfall dive in purchase apps stopped as rates fell.

However, with that said, whenever rates rise, it impacts the weekly data negatively, and last week’s purchase apps were down 4.8%. With mortgage rates rising back near 7%, this week’s application data will likely be negative.

When mortgage rates rose from 5.99%-7.10% earlier in the year, we had three weeks of negative data. Then as rates fell, the data line got better — traditionally, total volume peaks in May, and seasonality kicks in for the rest of the year. I am keeping an eye out in the second half of 2023. If mortgage rates fall noticeably, we might have another surge in demand late in the year which we have seen in the previous three years.

The week ahead

We are getting closer and closer to some short-term resolution to the debt ceiling issue, but the wild ride might still get crazier this week. The debt ceiling issue is a wild card for market activity this week, with or without a resolution, so the focus would be put there until it’s finished or punted until September. The market will pay more attention to that than economic data this week.

However, we do have some key economic reports this week, including new home sales, pending home sales, and the personal consumption inflation data on Friday, which the Fed wants to get closer to 2%. The world likes to pay more attention to the CPI inflation data, but core PCE at 2% is the Fed’s target level.

The marketplace knows that the growth rate of inflation peaked last year, but it’s trying to time the economic expansion and when the next job-loss recession starts. This is why I stress following jobless claims weekly. We need to keep an eye on the 10-year yield because, due to the debt default fiasco, bond yields can have a chaotic week, which could quickly be reversed up or down.

This is why these weeks, when we have political factors, we must be careful in making statements about a long-term change in the data. Once this drama story ends, we can focus on real economic data.