The US banking sector is still recovering from the worst turmoil since the 2008 financial crisis, but its troubles may be far from over.

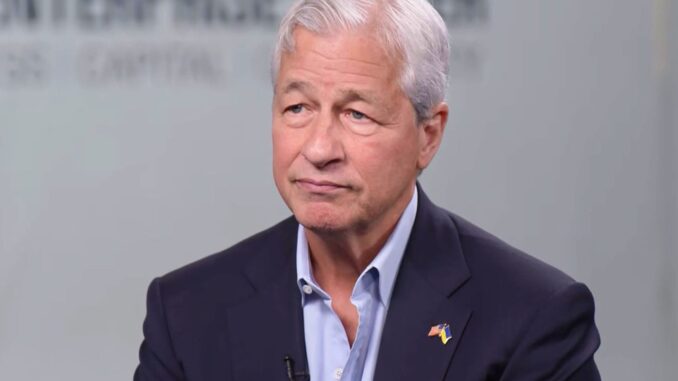

JPMorgan & Chase CEO Jamie Dimon has warned that the next jolt to the American banking system could come from commercial real-estate (CRE) loans.

Stress has been mounting for months in the commercial property industry, which is being buffeted by headwinds including high interest rates, tighter credit conditions, and work-from-home trends causing office vacancies. That’s fueling concerns about potential loan defaults by the more vulnerable borrowers in the sector.

“There’s always an off-sides,” Dimon said during the bank’s investor conference on Monday, per CNBC. “The off-sides in this case will probably be real estate. It’ll be certain locations, certain office properties, certain construction loans. It could be very isolated; it won’t be every bank,” he added.

Additionally, banks – especially smaller ones – should also brace for the risk of benchmark interest rates rising even higher, possibly up to 6% or 7%, according to Dimon. The Federal Reserve has boosted its policy rate to more than 5% currently, from near-zero levels in the first quarter of 2022.

“I think everyone should be prepared for rates going higher from here,” Dimon said, according to CNBC.

Small and mid-sized US regional lenders are highly exposed to the CRE industry – financing around 70% of all debt in the sector – and that’s made investors anxious about the overall health of the US financial system given the risk of CRE loan defaults.

Dimon said the banking industry is already building capital for potential losses by squeezing its lending activity.

“You’re already seeing credit tighten up because the easiest way for a bank to retain capital is not to make the next loan,” he said.