If you’re in the market for a new home, be aware that the upfront mortgage fees for Freddie Mac and Fannie Mae-backed loans have changed. Starting May 1, the fees dropped for borrowers with lower credit scores and rose slightly for those with stronger scores — a move designed to make homeownership more widely affordable. Here’s what you need to know about the new mortgage fee structure and how it could affect you.

Why are mortgage fees changing?

The Federal Housing Finance Agency (FHFA) oversees Freddie Mac and Fannie Mae, the government-sponsored enterprises (GSEs) that provide “liquidity, stability, and affordability” to the mortgage market. The agency recently revamped its loan-level price adjustment fee structure to improve housing affordability in the U.S. by reducing upfront homeownership costs and eliminating barriers related to insufficient credit. According to a Fannie Mae press release, the changes are part of a plan to facilitate “equitable and sustainable access to homeownership” nationwide.

What is a loan-level price adjustment?

Loan-level price adjustments (LLPAs) are risk-based fees that Freddie and Fannie charge. LLPAs aren’t new: They were introduced in 2008 (around the time of the financial crisis) to help offset Freddie Mac and Fannie Mae’s risk. LLPAs vary depending on various factors, including mortgage type, loan purpose, property type, loan-to-value (LTV), and the borrower’s credit score.

TIP: Most lenders convert LLPAs into the interest rate on the mortgage, which the borrower pays over time.

How the fee change works

For borrowers with lower credit scores, the fee changes shrink the penalty for having a low score to make homeownership more accessible. At the same time, homebuyers with higher credit scores might see increased fees but will still pay less than lower credit borrowers based on their lower risk to lenders.

For example, the fee for homebuyers with a credit score of 640 and a 20% down payment decreased by 0.75%, from 3% to 2.25%. Meanwhile, the fee for someone with a credit score of 740 jumped 0.375%, from 0.5% to 0.875% — still substantially lower than the fee for low credit borrowers.

On a $300,000 loan, the new LLPA structure results in a $2,250 savings for borrowers with a credit score of 640 and a $1,125 increase for those with a 740 credit score. With a $400,000 loan, buyers with a 640 credit score would save $2,000, while those with a 740 credit score would see fees increase by $1,500.

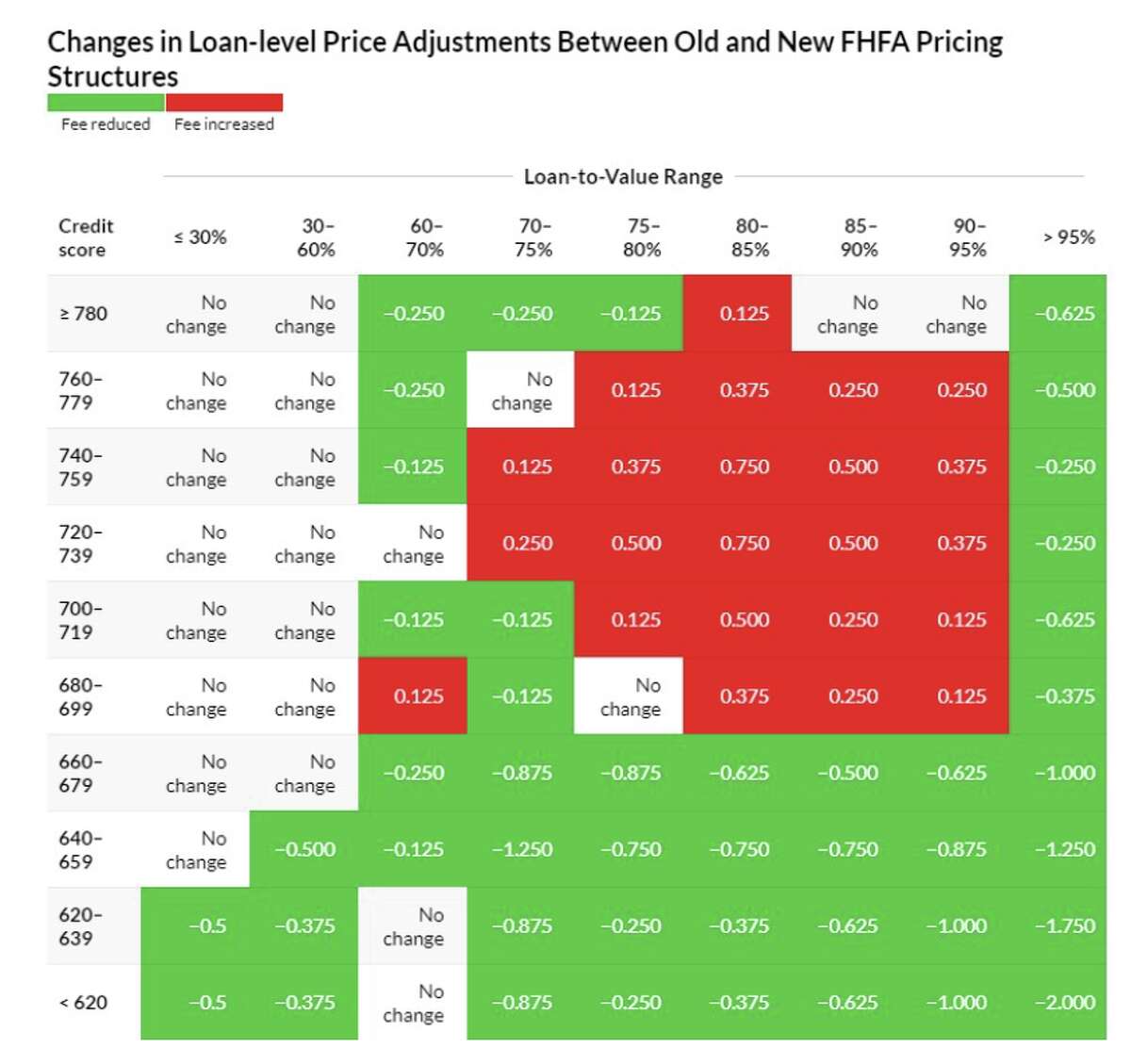

While the new LLPA fee structure doesn’t affect every credit score range and LTV, many levels have increased or decreased. The following table from the Urban Institute shows how the fees have changed between the old and new FHFA pricing structures:

The Urban Institute

TIP: Visit Freddie Mac and Fannie Mae to view new tables outlining the fees based on credit score and LTV (the loan-to-value ratio).

Which mortgages are affected?

Not all types of mortgages are affected by the new rules. Conventional and refinance loans guaranteed by Freddie Mac or Fannie Mae (regardless of lender) have changed under the new LLPA structure. However, FHA, VA, USDA, and HUD Section 184 mortgages are excluded.

Why is the change drawing criticism?

Critics say the new price structure penalizes buyers with strong credit scores who are struggling to enter the housing market due to high prices and mortgage rates. For example, while the National Association of Realtors (NAR) supports adjustments that reduce costs for some borrowers, they have concerns about increases for other consumers. “In the wake of a three-percentage point increase in mortgage rates, now is not the time to raise fees on homebuyers,” said NAR president Kenny Parcell in a January statement.

Other critics have suggested that Freddie Mac and Fannie Mae are overcharging people with good credit to undercharge those with bad credit — making homeownership harder for one group and easier for another. However, Jim Parrott, a nonresident fellow at the Urban Institute and owner of Parrott Ryan Advisors, says that criticism is misplaced and conflates “two separate, largely unrelated moves on pricing for the government-sponsored enterprises.”

Last year the FHFA increased the fees on loans that have less justification for government support — including loans for vacation homes, investment properties, luxury homes, and cash-out refinancing. According to Parrott, the “FHFA has used the increased revenues from those changes to decrease costs for people who genuinely need the help — borrowers with limited wealth or income.”

Parrott also notes that the suggestion that the FHFA is making homeownership unnecessarily pricey for some to make it cheaper for others leaves out a critical piece of the story. “Borrowers who put down less than 20 percent will still pay more in total fees for their mortgage because they will pay a private mortgage insurance premium in addition to their GSE fees.”

TIP: The FHFA also plans a new upfront fee for borrowers with a debt-to-income (DTI) ratio above 40%. The fee was slated to take effect May 1, but the FHFA has delayed the effective date by three months to ensure lenders have time to deploy the new DTI ratio-based fee.

Bottom line

Ultimately, people with lower credit scores and smaller down payments will still pay more than borrowers with higher credit scores and larger down payments under the new LLPA price structure. To find the best mortgage rates and terms, compare at least three lenders before making a decision. That way, you can find the best option for your credit score, LTV, and budget.

Source: www.sfgate.com

ENB

Sandstone Group