Given Friday’s job report, those who have been concerned with entrenched 1970s inflation — which would lead to double-digit mortgage rates — can put their disco shoes back in the closet.

I have tried to explain that the 1970s inflation isn’t a reality, and Friday’s report should ease the fear that wage growth is spiraling out of control. Since 2022 — as the labor market has been getting hotter with massive job gains and high job openings — the year-over-year wage growth data has been falling.

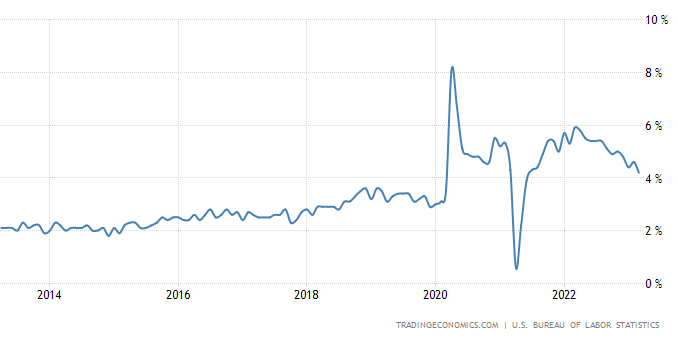

As you can see in the chart below, year-over-year wage growth peaked early in 2022 and has been in a clear downtrend for some time now. And even with sub-4% unemployment rates for some time, the annualized three-month wage growth average is 3.2%.

Let this sink in; while the labor market was booming in 2022 and 2023, the fear of a wage spiral never materialized. Wage growth is much stronger than what we saw in the previous expansion, but as we all know, when workers get higher wages, the Federal Reserve’s job is to kill that action, and they’re doing their best to do that again.

No entrenched inflation

The 10-year yield did spike on Friday, but I wouldn’t put much weight on that given it’s holiday Friday trading. As you can see below, if we had entrenched inflation, the 10-year yield would be well north of 5.25% today, and instead, even with a healthy labor market, the 10-year yield is closer to being under 3% than north of 7% as we saw in the late 1970s. I wrote recently about the 1970s inflation and mortgage rates.

From BLS: Total nonfarm payroll employment rose by 236,000 in March, and the unemployment rate changed little at 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in leisure and hospitality, government, professional and business services, and health care.

The monthly jobs report showed losses in construction, retail trade, and manufacturing, while the other sectors showed growth.

Here is a breakdown of the unemployment rate tied to the education level for those aged 25 and older

Less than a high school diploma: 4.8% (previously 5.8%)

High school graduate and no college: 4.0%

Some college or associate degree: 3.0%

Bachelor’s degree or higher: 2.0%

For those who did not follow me during the COVID-19 recovery period, I had a few critical talking points about the labor market:

The COVID-19 recovery model was written on April 7, 2020. This model predicted the U.S. recovery would happen in 2020, and I retired it on Dec. 9, 2020.

I said the labor market would recover fully by September of 2022, which means it would take some time before we could get back all the jobs lost to COVID-19. During this process, I predicted job openings would reach 10 million. Even in 2021, when job reports missed badly, I doubled down on my premise.

Now, depending on how long this expansion goes, we still are in the make-up mode for jobs.

Before COVID-19 hit us, our total employment was 152,371,000. We were adding over 200K jobs per month back then, and in early 2020 the job market was getting better as the trade war fears passed. Let’s assume we had no COVID-19, and job growth continued with no recession. It’s not far-fetched to say we should now be between 158-159 million jobs, not 155,569 000 as reported today.

As the chart below shows, we are still making up for lost time from the COVID-19 recession because we have over 166 million people in the civilian labor force, and the COVID-19 recession paused the job-growth trajectory we were on.

Labor market internals

I raised the sixth recession red flag on Aug. 5, 2022, so I am looking for different things in the labor market at this expansion stage. In the previous expansion — up until February 2020 — I never raised all six flags, and we had the longest economic and job expansion in history, which only ended due to COVID-19. However, that’s not the case today.

The last time I had six recession red flags was late in 2006. The recession didn’t start until 2008, and the credit markets showed much more stress then. Now, I am tracking the internal data lines, and jobless claims are No. 1. We can’t have a job-loss recession without jobless claims breaking higher, and so far, the data hasn’t warranted that conversation yet.

However, I have a target number for when I believe the Fed’s talking point will change regarding the economy, which is 323,000 on the 4-week moving average. We recently had some seasonal revisions of the jobless claims, which gave us a higher number to work with than before. Before the revisions, we were trending near 200,000 on the four-week moving average, and now that has been increased to 237,500, so the labor market isn’t as tight as before. The chart below is the initial jobless claims data after revisions.

The job openings data, which has been a staple of my labor marker recovery call since I was calling for 10 million job openings, is cooling off as well. As you can see in the chart below, the job openings data is now in a downtrend, which runs along with wage growth cooling down. I still put more weight on the jobless claims data over the job openings, but both charts show a less tight labor market.

From this job report, we are getting closer to being back to normal. Normal doesn’t have significant job gains or massive wage growth data that inspires fear of wages spiraling out of control. The question now is whether the Fed has done enough to get what they want — a higher unemployment rate — as they have forecasted a job loss recession this year with an unemployment rate roughly between 4.5%-4.75%.

My 2023 forecast for the 10-year yield and mortgage rates was based on the economic data remaining firm, meaning that as long as jobless claims don’t get to 323,000, we should be in a range between 3.21%-4.25%, with mortgage rates between 5.75%-7.25%.

If the labor market breaks, the 10-year yield could reach 2.73%, which means mortgage rates could go lower, even down to 5.25% — the lowest end range for 2023.

Without the banking crisis, bond yields would still be higher today, both on the long and short ends. However, the banking crisis has created a new variable that means tracking economic data will be more critical than ever. The bond market has assumed this will push the U.S. into a recession faster, so the 2-year yield has collapsed recently.

This means every week, as we do with the Housing Market Tracker article, we will keep an eye out on all the data lines that will give you a forward-looking view of the housing market. Even though bond yields rose Friday, this week was good news for long-term mortgage rates and the fear of wage growth spiraling out of control has been put to rest.

Once we get more supply in other sectors, we can make good progress on inflation. This means mortgage rates can go lower without the concern of breakaway inflation, as we saw in the 1970s.