If there’s one thing San Francisco, which is in the midst of complete and total collapse as a functioning U.S. city due to looting, drugs, crime and homelessness (not to mention sky high taxes), didn’t need, it was another problem to deal with.

But alas, along comes Silicon Valley Bank, and a historic bank run on regional banks led especially by banks who deal with VC, such as Silicon Valley but also First Republic Bank.

And it looks as though these banking instabilities could be the straw that breaks the city’s back, according to Bloomberg. Despite the problems plaguing the city for years on end, only now is San Fran “struggling to figure out its future”, Bloomberg wrote this week.

While it’s laughable to think that San Francisco wasn’t doomed prior to these bank runs, the situation does look to be getting even more dire. For example, Bloomberg writes that last week “city officials forecast a $780 million deficit for the next two fiscal years, more than $50 million worse than projected in January.”

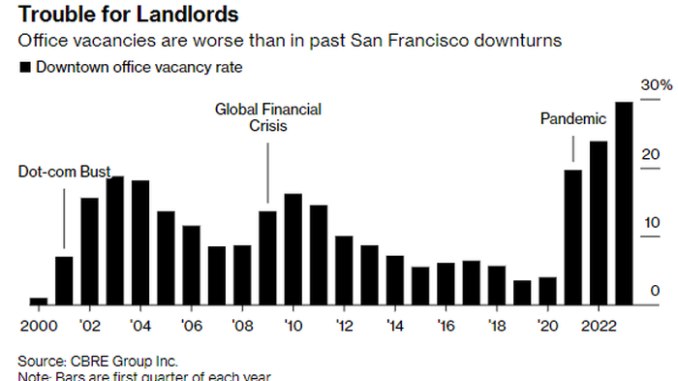

Meanwhile, in Q1, the city’s office-vacancy rate soared to a record 29.5%. This number stood at just 4% prior to the pandemic.

Michael Covarrubias, chief executive officer of local real estate developer TMG Partners and former head of the Bay Area Council, told Bloomberg: “We’ve never had this much vacancy in downtown San Francisco and a pandemic, followed by the work-from-home thing, followed by the banking thing started by Silicon Valley Bank and now sort of matriculating into the big banks, commercial loans and all that.”

Heidi Colin, a cashier at Dough and Little Griddle, a local luncheonette, said: “We used to have a morning rush, a lunch rush and a closing rush. Now it’s a mini rush, and we’re lucky if we even get it.”

Mayor London Breed, who famously encouraged defunding the city’s police just several years ago before drastically reversing course, is trying to enact legislation to help the city bounce back. However, it sounds as though she has given up on the San Francisco of old: “People are trying to equate success to the number of people who return to the office in downtown San Francisco, and we are not going to be what we were before the pandemic. We’re just going to be something different.”

Meanwhile, layoffs in tech numbering in the tens of thousands continue, with companies like Meta planning for another 10,000 layoffs globally. San Francisco Chief Economist Ted Egan added: “To lose this many jobs in three months is not something we’ve seen in the last few years. It’s definitely a warning sign.

Janice Jensen, CEO of Habitat for Humanity in the East Bay and Silicon Valley has banked with First Republic for more than 15 years and warns of what its loss could mean to the city: “To lose First Republic, that’d be terrible. It’s not just a bank. If it went away, it’d be a whole lot of tentacles into the community. That’s further stress on an already stressed area.”

And per commercial real estate experts, the worst in terms of vacancies could still be on their way. Colin Yasukochi, a researcher at CBRE Group Inc., said: “Usually in uncertain times, companies will delay decisions as long as possible,” he said. “Not moving is often cheaper than moving.”

Loading…

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack

Source: energynewsbeat.co