Your social media feed right now is probably abuzz with claims that the FHFA’s new loan level pricing adjustments (LLPAs) on conventional mortgages favor buyers with bad credit over buyers with great credit.

“A 620 FICO score gets a 1.75% fee discount and a 740 FICO score pays a 1% fee” reads one screenshot from a Fox News segment making the rounds on social.

Here’s the thing: that’s not true!

We’re going to break down the FHFA’s latest loan-level pricing adjustments, most of which are already in effect after being announced in January.

Let’s start with the basics: The pricing grid contains credit bands that correspond with upfront fees based on the mortgage product, loan-to-value ratio, occupancy, etc. Here’s the current model.

As you can see, the grid tops off at a 740 credit score, meaning anyone with a FICO score of 740 would pay the same rate on fees as someone with a score of 780. Under the current model, risk-based pricing (RBP) has been consistent. Generally speaking, the lower the credit score and higher the LTV, the higher the upfront fee to mitigate the risk.

The new model tweaks the risk-based pricing formula in significant ways.

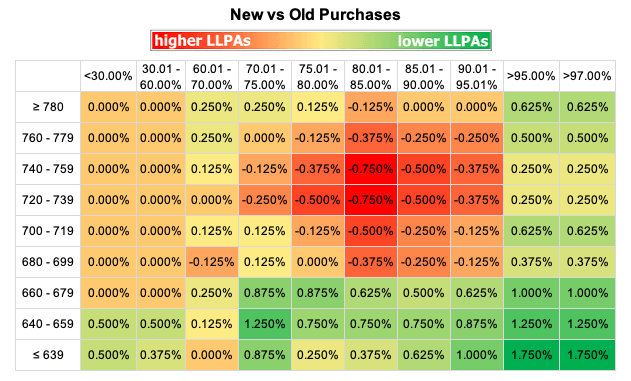

Here’s the new pricing matrix on purchase loans, which goes into effect on May 1 but practically speaking has been in place for more than a month. (This isn’t the grid the GSEs use, but it does show where changes are. Major props to Matthew Graham of Mortgage News Daily for creating this color-coded chart.)

There are new credit bands beyond the 740. You’ll also notice that the FHFA has increased fees on higher credit scores and lower LTVs. At the same time, the FHFA has lowered fees for borrowers with lower credit scores full-stop.

Let’s get one important thing out of the way – FICO borrowers with lower scores are not getting better rates than higher FICO borrowers. If you have better credit, you’ll pay less than someone with worse credit. But there are some key changes that amount to a cross-subsidy of sorts.

*Borrowers with credit scores between 680 and 779 with down payments between 10 and 20% will see a fee increase of between 0.13% and 0.75%.

*On the other side, first-time homebuyers with low or moderate household income pay no added fees whatsoever, and borrowers who put less than 5% down across all FICO scores will benefit.

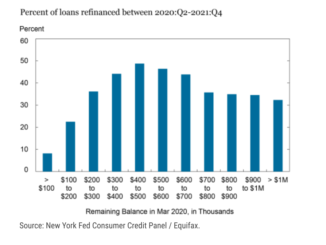

*This chart doesn’t show it, but consumers who will see the largest fee increase are those seeking a cash-out refinance, where 60% of the population analyzed by Experian would have experienced higher fees with an average increase of 55 bps.

Rebecca Richardson, a loan officer at UMortgage, had a smart take on the changes. Let’s take a look at her example, in which the sales price of the home is $400,000 and the scenarios are credit scores of 740, 700 and 660, with corresponding down payments of 3%, 5%, 10%, 15% and 20%.

“People with great credit are not getting penalized, nor are they subsidizing low credit score buyers,” Richardson said in a LinkedIn post. “And that’s primarily because people who were in the downpayment cheat code zone where they were putting more than 15% down but less than 20% had their terms subsidized by cheap mortgage insurance policies, which basically gave them the same terms as somebody who was putting 25% down. To me these changes are more about bringing things in line where the actual risk is based off of downpayment.”

ALRIGHT, BUT WHY IS THE FHFA DOING THIS?

This pricing change is in line with the Biden administration’s stated mission to provide housing financing opportunities to first-time homebuyers with lower credit scores and those in underserved communities.

There were always going to be winners and losers when the FHFA decided to change the pricing matrix. In this case, a portion of good-but-not-outstanding credit borrowers will receive a bit of a shock, a couple thousand dollars worth in some cases.

I think the FHFA is making a calculation that better-credit borrowers will still buy the home despite an increase in upfront fees and have enough skin in the game that risk isn’t high. At the same time, a couple thousand dollars could be the difference between a buyer with a lower credit score achieving homeownership or not.

Should this policy change come at the expense of those who are “doing things the right way,” as James Duncan, director of marketing at Thrive Mortgage, put it? It’s a fair question. This is a major change for the industry and setting a precedent on moving away from a pure risk-based model is…a risk for the FHFA (even if the agency disagrees with that interpretation).

Everyone acknowledges that the GSEs need to be better capitalized, but this policy would seem to hurt middle-class borrowers and aim to benefit those who are more likely to be in the FHA category. We’ll know pretty soon if this is a policy failure.

What do you think about it? Share your thoughts with me and the strategies you’re employing to help buyers make the best choice for their individual situation.

DataDigest is a newsletter in which HW Media Managing Editor James Kleimann breaks down the biggest stories in housing through a data lens. Sign up here! Have a subject in mind? Email him at james@hwmedia.com.