A look at the day ahead in U.S. and global markets from Mike Dolan

There was a sense of hesitation in world markets on Friday about whether dramatic re-pricing of U.S. and European interest rate horizon over the past month was an overreaction and a New Year economic burst might prove to be a temporary fillip.

Many central bank officials certainly seemed less quick to judgment. U.S. Federal Reserve officials wrestled on Thursday with whether recent data showing inflation, jobs and spending all hotter than expected was a flash in the pan.

“It could be that progress has stalled, or it is possible that the numbers released last month were a blip,” said Fed Governor Christopher Waller. Atlanta Fed President Raphael Bostic urged a “slow and steady” course of policy response.

Coming ahead of next week’s congressional testimony from Fed chair Jerome Powell and the critical February employment report, the comments seemed to calm the horses in markets – where borrowing rates had soared all week.

That take followed comments earlier in the week from Bank of England chief Andrew Bailey that further UK rate hikes were not “inevitably” needed.

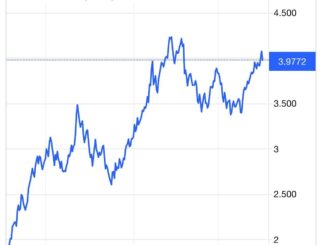

An almost 10 basis point recoil in the two-year Treasury yield from 15-year highs seems to have been enough to give stocks a lift late on Thursday and into the weekend. Ten-year Treasury yields are just about clinging to the 4% handle they assumed only on Thursday.

The resilience of stock markets more generally to the week’s bond market quake is notable and slightly puzzling – with implied volatility in bonds (.MOVE) climbing sharply while stock market equivalents (.VIX) subside.

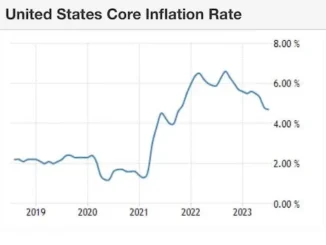

One argument for that is that the central banks may indeed hesitate to drive economies into recession and accept a slightly higher level of inflation. Two-year U.S. inflation expectations in the Treasury market climbed to 3% from 2% since early last month.

What’s more, a proxy Fed funds rate modelled by Fed researchers – showing the true level of policy tightness when you incorporate Fed guidance, market transmission and use of the Fed’s balance sheet – was already as high as 6.3% at the end of February. That’s 170bp above the prevailing policy rate.

There was some marginal cooling in incoming business surveys too on Friday. There was confirmation the recovery in euro zone business activity gathered pace last month but it was slightly less hot that early “flash” readings.

Activity in China’s services sector, on the other hand, expanded at the fastest pace in six months.

Elsewhere, there was some concern about the very remit of central banks. British lawmakers said on Friday that they were launching an inquiry into how the Bank of England’s operational independence was functioning.

In corporate news, shares in India’s embattled Adani surged almost 20% on Friday after a surprise $1.87 billion investment in the group by boutique investment firm GQG Partners eased concerns about the conglomerate’s ability to attract funds. An Australian pension fund client of GQG Partners questioned the firm for more information about its move.

British chip technology firm Arm, owned by Japan’s SoftBank (9984.T), said on Friday it would pursue a US-only listing this year, dashing the hopes of the British government that the tech giant would return to the London stock market.

In banking, Bank of America BAC.N and Citigroup <C.N> have cut some investment banking jobs in Asia, joining global peers in paring headcount as China dealmaking slows.

Key developments that may provide direction to U.S. markets later on Friday:

* U.S. and global Feb service sector surveys

* U.S. Federal Reserve Board Governor Michelle Bowman, Atlanta Fed President Raphael Bostic, Dallas Fed chief Lorrie Logan and Richmond Fed chief Thomas Barkin all speak

* U.S. President Joe Biden meets German Chancellor Olaf Scholz at the White House

* Foreign ministers of the Quad countries — the United States, Japan, Australia and India — meet in New Delhi

ENB

Sandstone Group