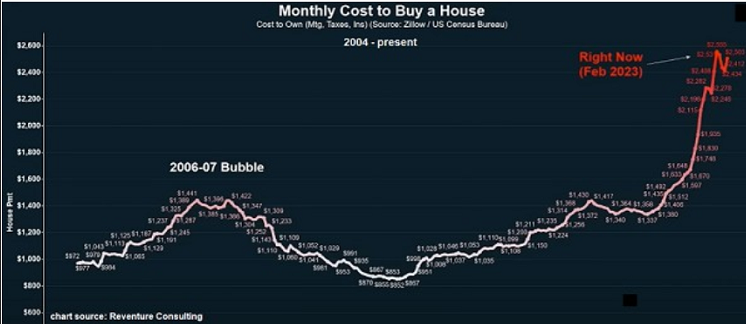

The U.S. housing market is currently the least affordable in at least 25 years:

Affordability is, generically, the ratio of monthly income vs. the median price of a home. Essentially the degree to which a potential home buyer can afford the basic monthly payments on a home. Here’s another way to look at affordability in terms of the monthly cost (mortgage, taxes, insurance) to buy a house:

Currently, the average house payment is $2,503 per month. This is nearly double the amount at the beginning of 2021. Note that this does not include the cost of maintenance, HOA dues, utilities, etc. In many markets, it’s now much cheaper to rent than to buy.

The mortgage purchase applications index took another hit for the week ended Feb. 24, falling 5.6% from the prior week. The index is down 45% from a year ago and is at its lowest level since 1995. The base 30-year fixed rate mortgage rose to 6.71%, its highest since mid-November. Keep in mind the “base” rate is for an agency-guaranteed (conforming) mortgage with 20% down and at least a 740 FICO. For most potential homebuyers, the mortgage rate is well over 7%.

The pending homes index for January jumped 8.1% vs. December on a seasonally adjusted, annualized rate basis, though it dropped 24.1% YoY. December was revised lower to +1.1% vs. November from the +2.5% originally reported. This is unsurprising given the big bounce in mortgage purchase applications during January.

In addition, the downward revision to December’s number makes the MoM percentage increase appear larger. Pendings are based on contracts signed on existing homes during the month. Per the stunning plunge in the mortgage purchase applications index, the January bounce in home sales activity will be very short-lived.

And let’s examine the narrative that there’s a “housing shortage:”

Per the Bureau of Economic Analysis and the Census Bureau, the housing stock per capita in the U.S. is considerably higher than at the peak of the previous housing bubble. Compounding this problem is the fact that a record number of new homes are under construction. Many started based on contracts signed that have now been canceled.

The homebuilder and related stocks continue to trade at lofty levels vs. what I would expect, given the deteriorating fundamentals and intensifying headwinds (rates moving higher, low affordability, falling prices). The entire stock market seems to be hanging on the hopes of a Fed pivot, particularly homebuilder investors.

But even if the Fed were to start cutting rates, affordability would remain an issue, particularly for first-time buyers. According to the National Association of Realtors, first-time homebuyers dropped to a record low in 2022, making up only 26% of all buyers, down from 34% in 2021 and a peak of 50% in 2010.

First-time buyers are the most likely purchasers of homes being sold by prospective move-up buyers. If the latter are unable to sell their home, it removes a large percentage of potential buyers of upper-middle priced and luxury homes. As such, it’s my strong view that new home sales volume and prices will continue to head south, homebuilders will eventually start losing money, and stock prices will tank.

DR Horton Stock to Head Lower?

DHI has had a big run-up since late October but reported ugly new order numbers and is now lagging behind the sector. It now looks attractive as a short:

I don’t show the comparison in the chart above, but DR Horton (NYSE:DHI) has lagged the sector (DJUSHB, XHB, ITB) since February 21st. I reviewed DHI’s FY 2023 Q1 numbers after it reported in late January. Its new orders fell 38% YoY, the backlog of homes under contract dropped 46%, and the dollar value of its backlog declined 43.6%.

But the backlog will become uglier. DHI’s cancellation rate was 27% vs. 15% a year ago. I anticipate that the cancellation rate will continue to climb, and the current backlog will continue to incur a rising rate of canceled contracts.

I believe that DHI will fall back minimally to the $68 level, a 26% decline from its current price, within six months. I think it could drop to $40 or lower over the next 12 to 18 months. $40 is the price from which it took off higher in April 2020 after bouncing from its pandemic low of $30.

Source: www.investing.com