If there’s one sector of the economy that benefits from the very low levels of total housing inventory, it’s the homebuilders, but for a reason you might not think. If national housing inventory were back to normal, we would have 2 to 2.5 million active listings, and these active listings would be direct competition for the builders.

New homes are traditionally more expensive than existing homes, which don’t have all the bells and whistles. However, with active listings now near all-time lows, the builders’ new homes still have more value in the housing market than what we saw in previous decades.

The homebuilders don’t build millions of homes simply waiting for them to get bought; they build homes when they’re confident they can sell at the right price. This business model means that the builders are very mindful of the demand for their product and keep an eye out on their main competition, the existing home market, where supply is cheaper for a buyer.

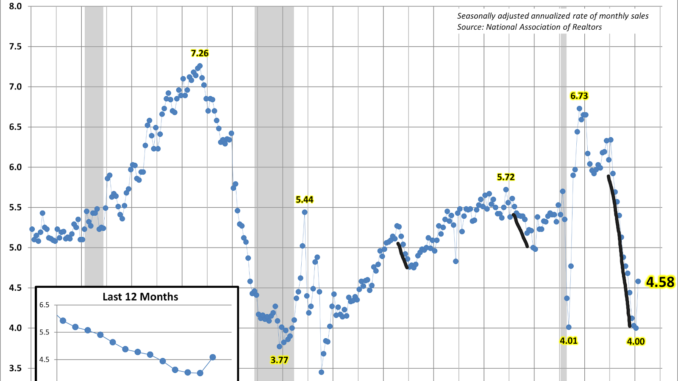

Back in 2007 — after existing home sales got as low as we have seen in the recent data as the chart below shows — total active listings were above 4 million.

Contrast that with the chart below, which shows that the total active listing today is 980,000. This is a massive difference in inventory data and a plus for the homebuilders, which they didn’t enjoy in 2007.

This means the builders have less competition for their product, giving them time to work off their backlog. They can cut prices, pay down mortgage rates for their buyers, and do what they need to to make it work for them to move their products. All this is happening while housing permits have fallen noticeably from the recent peak.

As housing permits keep falling, we should be seeing falling housing completions.

However, due to the COVID-19 delays, the homebuilders are still working through their backlog of homes, and with a lot less competition this time around, they have more time to do this.

As I have stressed time after time, we shouldn’t be using the housing economic models of 2002-2008 — that would have led everyone to believe we had a mass supply of housing coming online in 2022. We didn’t have the credit stress issue from 2010-2023 like we did from 2005 through 2008. As you can see, this was a blessing for the builders while they worked off the backlog of homes.

New home sales

From the Census Bureau: Sales of new single-family houses in February 2023 were at a seasonally adjusted annual rate of 640,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.1 percent (±15.3 percent)* above the revised January rate of 633,000, but is 19.0 percent (±12.9 percent) below the February 2022 estimate of 790,00.

As we can see in the chart below, we’ve only seen a little movement in the new home sales market for many months, except when mortgage rates fell and homebuilders could move more houses. Rates did spike from 5.99% to 7.10% recently, impacting the data coming up. However, imagine if the housing market could get mortgage rates below 5.75%, then head toward 5% and stay there for some time. That will be a much better environment for the builders.

From Census: For Sale Inventory and Months’ Supply The seasonally adjusted estimate of new houses for sale at the end of February was 436,000. his represents a supply of 8.2 months at the current sales rate.

I have a straightforward model for when the homebuilders will start issuing new permits with some kick and duration. My rule of thumb for anticipating builder behavior is based on the three-month supply average. This has nothing to do with the existing home sales market; this monthly supply data only applies to the new home sales market, and the current 8.2 months are too high for them to issue new permits with any natural steam.

When supply is 4.3 months and below, this is an excellent market for builders.

When supply is 4.4 to 6.4 months, this is an OK builder market. They will build as long as new home sales are growing.

The builders will pull back on construction when the supply is 6.5 months and above.

So, as we can see below, the homebuilders are no longer dealing with spiking supply data but a slow-moving downtrend that still needs much work. However, there is a lot more to this story.

We have had many people on social media sites saying a massive housing supply will hit the market soon because we have a record amount of homes under construction. This really isn’t how the supply channels work for the builders.

As we can see in the chart below, even during the worst days of the housing bubble crash, the builders never had 200,000 homes available for sale. In standard times we are between 80,000 and 100,000 homes for sale. Here is a breakdown of the supply data in today’s report.

8.2 months of supply equals:

1.4 months of completed homes: 72,000 homes

5.0 months of homes under construction: 269,000 homes

1.8 months of supply that haven’t even been started: 95,000 homes

In the chart below you can see the context of the 72,000 new homes available for sale today.

Overall, new home sales have been more of the same story for many months now. When mortgage rates fall, homebuilders can move more product, but not much is happening for this sector until the backlog of homes can get off their books and monthly supply can get below 6.5 months.

Once that happens, new home sales will start to grow again enough that the builders issue more permits. The builders are feeling much better about their prospects, as the recent builders’ confidence data shows. Remember, context is critical; the builders’ confidence is coming off a historic dive with nothing to do with the COVID-19 delays.

Mortgage rates have been all over the map this year, but have yet to break above our highs last year. Recently they have come down, and the last three weeks had positive purchase application data, which offset the three weeks of negative purchase application data we had when rates spiked from 5.99% to 7.10%. If we can just get some calm, dull months of mortgage rates, the stress on the housing market — and all the people trying to buy and sell houses — will ease.