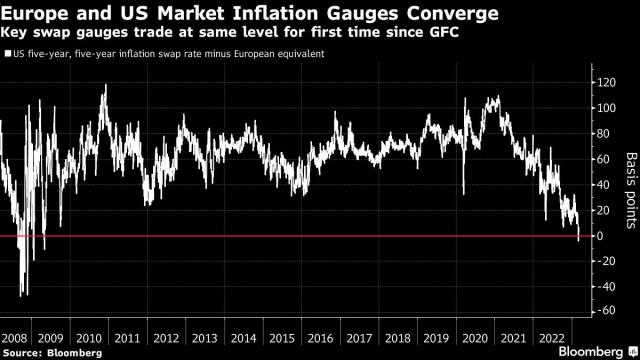

A proxy for inflation expectations in the euro area in the second half of the next decade — the so-called five-year, five-year forward inflation swap rate — is at roughly 2.5%, catching up with the US on wagers of prolonged price pressures.

That’s a monumental reversal for the region where central bankers, conversely, turned to negative rates and bond-buying to fan the economy and below-target inflation for most of the past decade.

Inflation expectations dropped on both sides of the Atlantic, reversing an upward trend, after this week’s comments from European Central Bank member Robert Holzmann and Federal Reserve Chair Jerome Powell, but Europe’s gauge remains within touching distance of the US.

The move also follows a strong repricing of markets’ bets on the peak for interest rates in the US and Europe, with traders anticipating more tightening.

“Eurozone inflation could be more persistent,” said Morgan Stanley strategist Andrew Sheets. “But take a step back and consider just how much confidence the market used to have in the other direction.

Have all those structural drivers of lower growth and inflation really gone away?”

Long-term measures of European price pressures lagged US equivalents for years since the global financial crisis before consumer prices last year surged to a record.

Concerns around energy security and wage pressures are contributing to speculation of an inflationary regime shift.

Policy makers have been under pressure as measures of inflation expectations through tradable securities have jumped.

European officials got some relief from survey data Tuesday showing consumer expectations for euro-zone inflation receded ahead of next week’s rate decision, with a half-point hike in the deposit rate to 3% all but guaranteed.

“It’s fair to say that we struggle to remember an occasion when such a relatively obscure data release brought about such a significant reaction,” said Rabobank analysts including Richard McGuire.

“This highlights the importance of inflation expectations to the ECB’s rate hike path and the very subjective way in which this has to be measured.”

For now, most analysts are skeptical the convergence of US and European inflation risk can persist. Evelyne Gomez-Liechti, a rates strategist at Mizuho, sees the European gauge falling in the medium-term.

“I don’t think we are in a change of regime where EUR inflation expectations permanently stay where the USD expectations are,” she said. “That said, in the short term, the spread may continue to be very narrow.”

–With assistance from Alice Gledhill.

Source: finance.yahoo.com