Inflation is hot, so why aren’t mortgage rates over 10% like we saw in the 1970s? Put those disco pants back in the closet; this isn’t the 1970s, John, and the bond market has been saying this to anyone who would listen.

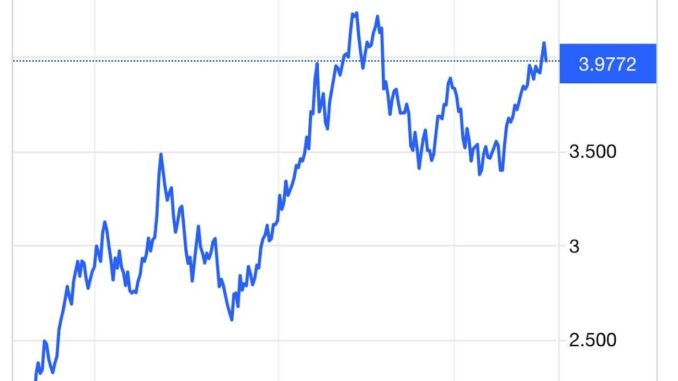

Mortgage rates have trended up to over 7% while the 10-year yield has been around 4%, so everything is in the top-end range of my 2023 forecast. But given how high inflation is right now, why aren’t rates even higher? This is a good question because the answer can clear many things up with inflation and mortgage rates.

How I look at mortgage rates ties back to where I think the 10-year yield range will be. This means mortgage rates should stay in the forecast range for the year unless some new variable, like COVID-19, a new war or a more aggressive or dovish Fed happens. The 2023 forecast ranged from 3.21% to 4.25% on the 10-year yield, meaning mortgage rates of 5.75% -7.25%.

Not only has the data stayed firm, but the economic data has improved recently.

Also, gas prices are down from the peak, and the inflation growth rate is no longer skyrocketing. If the labor market breaks this year, meaning jobless claims noticeably rise, that should send the 10-year yield to 2.73%, and mortgage rates can go as low as 5.25%.

Jobless claims have been solid for some time, and this is a big reason why I don’t believe the Federal Reserve is going to pivot outside of this. They often made it clear they want the labor market to break, so go with that premise until they say otherwise.

Housing permits will fall all year, but sales picked up recently, a positive for the economy, meaning more transfers of commissions. An improving economy puts more risk to the upside in rates and bond yields, especially if inflation data picks up.

If the opposite was happening, economic data would get weaker with less consumption and more people filing for unemployment claims. Rates should fall because, unlike in the 1970s, lower economic growth and fewer jobs should not create more inflation as it did in 1974.

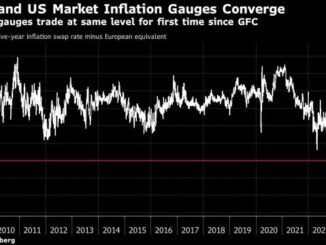

It’s true that inflation is booming like we haven’t seen since the 1970s, but the reality is that if the bond market believed in entrenched inflation, it would have been pricing the 10-year yield much higher over the last year.

CPI inflation took off a few times in the 1970s, along with mortgage rates and the 10-year yield. Now inflation has taken off again, but mortgage rates have yet to get above 8% as we saw in the mid to late 1970s, and the bond market has also not broken over 5.25% on the 10-year yield. Also, the Federal Reserve isn’t discussing taking the Fed Funds rate back to late 1970 levels either.

Housing in the 1970s was booming!

Have you ever wondered why the Federal Reserve said we needed a housing reset in March 2022 but not a labor market reset? They’re targeting the labor market in the sense that if more Americans lose their jobs, we will have more supply of workers, which will lead to less wage growth and less inflation. However, they didn’t use the word reset regarding the labor market.

The Federal Reserve said it doesn’t want the 1970s entrenched inflation. This means if you’re to believe them, they’re scared to death of a housing boom! In the 1970s, we saw three renting inflation booms, but the entrenched inflation in the mid to late 1970s is what they don’t want to see again.

Even with the recession in 1974, inflation and rates grew, and in the late 1970s inflation and housing demand were booming higher. I don’t believe they believe in this type of inflation, so they’re talking about getting closer to the end of their rate hikes.

Since 43% of core CPI is shelter inflation, you can see why rents are so important. After the 1970s, the growth rate of inflation cooled off as rent inflation cooled off and was pretty stable up until the global pandemic, as you can see below, the year-over-year inflation growth rate.

It’s well known now that the CPI rent inflation data lags badly, and we are already seeing the growth rate of rent cooldown, something I talked about on CNBC last September on CPI inflation day.

From CoreLogic:

Now look at the shelter inflation data of CPI today; big difference. To the Fed’s credit, they did create an inflation index to take shelter inflation away from the conversation, meaning they want to focus more on service inflation due to the lag in rent inflation.

Again, this is why I believe they’re scared of 1970s inflation, but they also know deep down inside, as the bond market knows, we don’t have the backdrop of 1970s inflation. I wasn’t sure if they knew of the lag aspect for a while there, but they resolved this by creating their index in December that it doesn’t count housing inflation.

We have a record number of five-unit construction going on, so the most significant component of CPI is already falling in real terms. We have a good supply coming online, too, with the Fed doing what it can to cool the economy down.

So the outlook is good here on preventing a 1970s inflationary boom on rent growth. As we can see below, the 1974 recession also killed the growth of 5 units under construction. This is not the case today!

I have noticed recently that people don’t know how much housing boomed back in the mid to late 1970s. Existing home sales doubled before we saw the collapse in demand. We went from 2 million to 4 million and back to 2 million. We aren’t in the boom sales demand stage today as existing home sales had the biggest one-year monthly sales collapse.

So, while I am not a Fed pivot person until jobless claims break over 323,000 on the four-week moving average, I did have the peak 10-year yield at 4.25% this year with a 7.25% peak mortgage rate level. I am not blinded to the reality that inflation and growth have limits as rates rise, with the supply of five-unit coming on line.

I believe the bond market has always known this, which is why the high inflation levels, the 10-year yield, and mortgage rates don’t look like the 1970s today.

Why would it be less likely for mortgage rates to rise from these levels versus why they would be more likely to fall?

The growth rate of inflation is already cooling off, supply chains are getting better, rental inflation will eventually catch up into the inflation data, plus we have more supply of rental units coming on line. All these things point to us not having a 1970s redux.

It’s getting from here to there that will have a lot of economic noise and confusion, and the Fed doesn’t do itself any favors when they talk weekly and sound like they’re confused about what to do.

However, with that said, we should have a three-handle on the Core PCE growth rate of inflation by the end of the year. Back in the 1970s, this data line which is the Fed’s main target level, was nearing 10%. Today it’s at 4.7% and even the Fed’s forecast shows this slowing down by the end of the year.

While we aren’t going to hit the Fed’s target of 2% year-over-year growth on inflation this year, the growth rate of core PCE is slowing down already, which shows why the Fed and the bond market don’t believe we are going to get to 1970s-level inflation.

We have a lot of noise about rates and inflation lately, and some people say that to destroy inflation, we need a stronger-than-expected job loss recession, such as we saw in the 1970s. Hopefully, the data I showed you today can put the 1970s to rest.

If your baby boomer friends are afraid of the 1970s again, give them a hug and tell them everything will be ok; we will survive this. Don’t forget that Fed rate hikes have a lag, because they have a lagging impact to the economy, the Fed really wants to stop hiking soon, so they don’t have to cut rates faster than they want.