U.S. companies from truck maker Oshkosh Corp. to consumer-goods conglomerate Newell Brands Inc. are moving away from “last-in, first-out” accounting, or LIFO, for their inventory, as inflation continues to pressure businesses’ earnings.

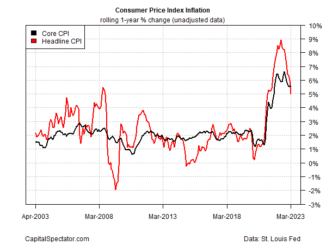

Elevated inflation has weighed on companies’ earnings over the past two years, and economists expect it to remain above recent norms at least through this year. The producer-price index, a closely watched gauge of inflation at the wholesale level, rose 4.6% in February from a year earlier—well off the 11.7% annualized peak in March 2022 but still historically high.

One lever finance executives have to combat the impact of inflation on earnings is to make an accounting-policy change: moving to “first-in, first-out” accounting, or FIFO, instead of LIFO. Switching to FIFO can boost a company’s profitability because older inventory acquired at a lower cost is used to value the cost of goods sold on the income statement. Through FIFO, businesses can also better align their inventory accounting across global operations, as the method is allowed under International Financial Reporting Standards while LIFO isn’t.

Oshkosh made the switch late last year to FIFO for its U.S. inventory, or 80% of its total, as the Oshkosh, Wis.-based company experienced a growing disconnect in the timing of its cost of goods sold and revenue on its income statement due to rising inflation, Chief Financial Officer Michael Pack said.

“Certainly inflation plays into it,” Mr. Pack said of the accounting shift, adding that many of the company’s peers were already using FIFO. “We think FIFO does result in a much better presentation on our balance sheet.”

Businesses have been heading toward FIFO over LIFO for years—particularly with the rise of tech companies, whose costs tend to fall over time—but such activity appears to have accelerated amid a turbulent economy. About 30 U.S. companies total in 2021 and 2022 switched their inventory accounting method to FIFO from LIFO, according to a review of public filings from investment research firm Bedrock AI. That is up from a combined 13 companies in 2019 and 2020, when inflation was less of a concern. No companies have switched to LIFO from FIFO since 2019, Bedrock AI found.

On average, an estimated 55% of companies in the S&P 500 used FIFO as their primary inventory method and 15% used LIFO, according to Credit Suisse Group AG, citing annual reports from 2021 and 2022. The rest of the companies used other options such as the average-cost method or a combination of methods, Credit Suisse said.

LIFO allows companies to use additional cash up front from their lower tax bills to invest in their businesses, but it also increases reported costs of goods sold and hit earnings. The method is a cost assumption companies make on financial statements but generally doesn’t reflect the actual flow of inventory in their operations.

Some companies could view it as less costly to switch off LIFO since a 2017 law lowered the corporate tax rate to 21% from 35%, said Michelle Hanlon, an accounting professor at the Massachusetts Institute of Technology’s Sloan School of Management.

“Going off LIFO is a pretty big decision, because [using] it saves companies on taxes,” Ms. Hanlon said. “Taxes are kind of at a low rate and inflation is high, so companies’ calculus might be changing due to all these factors combined,” she said.

Rising inflation brought the issue to the attention of executives at truck maker Paccar Inc. by increasing its reported expenses, a distortion when compared with its peers, Controller Michael Barkley said. The Bellevue, Wash.-based company last year switched to FIFO for about 40% of its inventory, as the rest was located outside the U.S., to align more with its competitors in Europe and elsewhere internationally as well as other firms that don’t use LIFO.

“When inflation popped up, we said we’re taking hits to our margin that make us noncomparable. And for what?” said Mr. Barkley. “It made a lot of sense just to switch over. In periods of low inflation, [a switch to FIFO] doesn’t make that big a difference, but in periods of high inflation, it obviously makes a bigger difference.”

Companies in other industries such as consumer goods, oil and gas, chemicals and medical technology also have made the move over the past year.

Newell Brands, the owner of Yankee Candle, Sharpie and other consumer brands, in February said it shifted certain U.S. inventory to FIFO from LIFO to conform all of its supply to a single method of accounting. The Atlanta-based company said its cost of goods sold under FIFO in the quarter ended Dec. 31 was $4 million higher than it would have been under LIFO. The company declined to comment.

Other businesses are stepping up their analyses of whether to switch. Sporting-goods retailer Academy Sports & Outdoors Inc. is evaluating and expecting such a move, which could help the company avoid a potential earnings charge if inflation continues to rise, CFO Michael Mullican said.

But a switch doesn’t come free, either. Leaving LIFO would necessitate submitting a cash payment to the Internal Revenue Service over four years, a cost other firms may view as justifying the benefits. The Katy, Texas-based company is evaluating the potential size of the payment but expects it to range from $40 million to $60 million, Mr. Mullican said.

“As inflation keeps going up, it’s something we’ve got to keep watching,” Mr. Mullican said.

Source: www.wsj.com