Last week was wild, and not just for the housing market. We had a 21st-century bank run on Silicon Valley Bank and then the federal government took action over the weekend to stop the contagion. Mortgage rates fell even though the jobs report was stronger than anticipated.

The bank failure spooked bond traders who were looking for higher yields and rates. They reversed their bearish take on bonds, and people started to buy the 10-year yield, causing mortgage rates to fall.

As a result, mortgage rates, which climbed as high as 7.05% last week, fell to a low of 6.76% on Friday.

Here is a quick rundown of the last week:

Purchase application data rose 7% weekly, still down 42% year over year.

Weekly inventory fell by 6201, and new listing data is down noticeably from last year, which was different than last week.

The 10-year yield, already at a key critical level, couldn’t break higher but reversed and went lower Friday after the jobs report and the news around Silicon Valley Bank.

10-year yield and mortgage rates

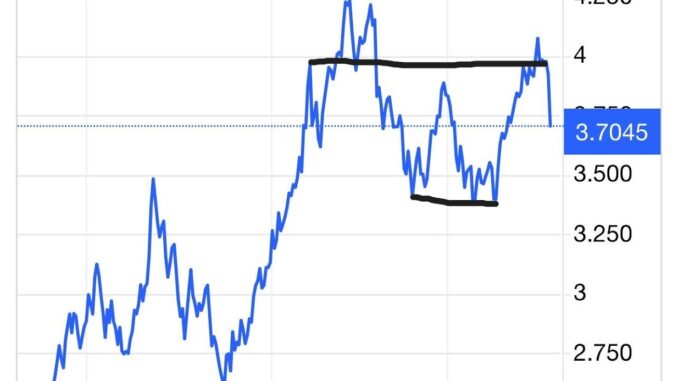

In my 2023 forecast, I posited that if the economy stayed firm, the 10-year yield range should be between 3.21% and 4.25%, equating to mortgage rates of 5.75% – 7.25%. If the economy gets weaker and we see a rise in jobless claims, then the 10-year yield should go as low as 2.73%, translating to 5.25% mortgage rates. This assumes the spreads are wide as the mortgage back securities market is still very stressed.

Of course, jobless claims are nowhere near the level where I think the Fed would pivot — which would be 323,000 on the four-week moving average — and the economic data has been firm so far this year. So, the 10-year yield range I am focusing on is between 3.21% and 4.25%, and even with all the crazy economic data, inflation data, a bank run and the Fed getting grilled for actively trying to raise the unemployment rate, the range has stuck so far.

When the 10-year yield tried to break under 3.42%, I talked about how that was a hard level to crack, and around 3.95% was another hard level to break. The channel level still looks correct. The chart below shows the 10-year yield as of the close of business on Friday.

After the failure of Silicon Valley Bank, the government this weekend threw everything it had at this national crisis to save the depositors and prevent future bank runs. As a result, the 10-year yield is trading at the levels below on Sunday night. Already, the future pricing of a .50% rate hike collapsed tonight.

The question now: Is the Fed done raising rates? Do they even want to risk more stress in the markets? Those who have followed me in HousingWire know my take on this; they could have claimed victory by front-loading so many rate hikes and called it a day.

Instead, they chose a different path recently by discussing more aggressive rate hikes. As I am typing this out on Sunday evening, it’s clear they flew too close to the sun and had to deal with a banking crisis.

Weekly housing inventory

Here we go again; we still haven’t hit the elusive bottom for seasonal inventory, which makes this the third year in a row that the bottom in inventory will happen in March or beyond.

According to Altos Research data, housing Inventory fell by 6,201 over the last week; the decline is less this week than last. We should be reaching the seasonal bottom soon: Last year, inventory bottomed out on March 4.

Weekly inventory change (March 3 – March 10): Fell from 418,736 to 412,535

Same week last year: (March 4 – March 11): Rose from 240,194 to 247,320

To give you some perspective, active listings during this week in 2015 were 960,231, rising steadily from earlier.

The next inventory data to consider is the new listing data, which is still at all-time lows this year since it hasn’t recovered from last year when mortgage rates got over 6%. It will be more interesting to see the year-over-year data in May, June and July when seasonal inventory is peaking.

Last week, the year-over-year data was only down a smidge. This week, it’s a more noticeable decline in the year-over-year data from 2022 and 2021:

2021: 60,434

2022: 60,328

2023: 51,453

For some historical reference, pre-COVID-19, new listing data for this week were:

2016 79,144

2017 80,419

2018 80,682

You can see this long-term downtrend in the inventory data using the NAR data, which was uncommon from 2000 to 2005. Inventory grew during the housing bubble years because housing credit was much looser back then, and people could move more freely. Now, people live longer and longer in their homes, something I wrote about in January 2020 before COVID-19 hit us.

Also, credit channels are back to normal, meaning you move when you can move, no more exotic loan debt structures to facilitate that move.

Using the NAR data, this was the premise of my forecast last year for housing inventory to break over 1.52 million in 2023. This is also a four-decade low in inventory before COVID-19. My 2023 inventory forecast needs a lot of help, as new listing data isn’t growing at all still. Per the last existing home sales report, we are at 980,000.

Since new listing growth is running at all-time lows, reaching 1.52 million could happen only because of duration. Homes are taking longer to sell so we are back to normal in that category.

Purchase application data

Now we are using a shallow bar here on purchase application data, but we did have a weekly gain of 7% week to week, breaking the streak of three negative reports.

The seasonality of the purchase application data has less than three months now as traditionally volumes fall after May. If that occurs without a solid run higher in apps, we might need to wait for mortgage rates to fall more to get an increase in this data, much like what we saw Nov. 9, which stabilized the housing demand data before rates spiked back to 7.10% recently.

With mortgage rates falling last week and using even a lower bar than what we had on Nov. 9, 2022, I will be very interested to see if we can get some traction with the application data, especially if rates keep falling.

The week ahead

First, we will digest all the weekend drama about bank failures and then we will get back to economic data.

We have a lot of economic data this week, including two inflation reports: CPI on Tuesday and PPI on Wednesday. Retail sales surprised us to the upside last time, but that is not all. We also have two housing reports: the builder’s confidence and housing starts this week.

It’s been a hectic 72 hours for the markets, and we need to take a breath to consider what the Fed will do next on rate hikes after the banking system needed several emergency all-hands-on-deck meetings over the weekend.