Stubborn inflation and high interest rates continue to wreak havoc on the mortgage-origination market, but there is one asset class in the housing market that is arguably flourishing in these hard times – home equity.

Along with the solid base of home equity that now exists — a byproduct of the rapid home-price appreciation in recent years — there also has been an increase in demand by borrowers to tap that equity. A host of nonbanks and traditional depository lenders, such as banks and credit unions, as well as a growing number of fintech firms continue to ramp up efforts and product lines to meet that demand.

Among the nonbanks that either have or plan to introduce HELOC loan products are United Wholesale Mortgage, Rocket Mortgage, Guaranteed Rate, loanDepot and New Residential Investment Corp. (rebranded as Rithm Capital).

“Customers [lenders] are calling us asking is this a product that we should originate in the absence of cash-out refinance,” said John Toohig, managing director of whole loan trading at Raymond James. “They are saying, ‘Tell me what’s working, how can I stand a program up so I can capture some of this [home-equity] business.”

Toohig adds that lenders are telling him that their customers “don’t want to do a new 30-year fixed-rate mortgage at 6.25%, and we’d rather do a smaller-balance HELOC [home equity line of credit] instead to improve their property.”

Toohig said increasing the pressure on the mortgage-origination market are the Federal Reserve’s continuing benchmark rate bumps and other market signals that together point to interest rates heading higher. “I think in 2023, we’re going to see rates higher for longer,” Toohig concludes.

Through the market turmoil and volatility that marked much of 2022 — and is still with us today — home-equity lending expanded, however. Toohig said Raymond James finished the year with some $1.1 billion in HELOC trading volume, which he described as a “monster” year.

“Our previous best year for HELOCs was 2015, and that was about $320 million,” he added.

Closed fixed-rate second-lien [home-equity] loans have been up the least in terms of volume, Toohig said, with HELOCs leading the charge — along with unsecured personal loans used for home improvement. (A recent report from credit-rating firm TransUnion shows that unsecured personal loan balances hit a record $222 billion in the final quarter of 2022 — “driven by record-high originations in the first half of the year.”)

The most common HELOC Toohig is seeing, he said, is “a 10-year, IO [interest-only] 20-year amortization, with a lien secured in a second position.” Toohig added that the interest rate on a HELOC is normally variable, “usually prime, plus 1.5 to 2 points.” As of March 8, according to Commerce Bank, the prime rate was 7.75%.

Though “it’s not cheap money,” Toohig said it’s on “smaller balances of $50,000 to $100,000, not a $400,000 mortgage,” so that makes it more attractive to homeowners, especially those not interested in giving up their low 3% mortgages by refinancing to pull out equity at new rate that is twice as high today.

HELOCs rising

Toohig’s sense of the HELOC market from his perch as a loan trader matches the broader rising market numbers for the product. A recent report by the Federal Reserve Bank of New York shows that balances on HELOCs jumped by $14 billion in the fourth quarter of 2022, “the third consecutive quarterly increase and the largest increase seen in more than a decade.”

The Fed report shows HELOC balances nationwide stood at a total of $336 billion at yearend 2022. ATTOM, a real estate data provider, reports, however, that the “severe contraction across the lending industry in the fourth quarter of 2022 even hit HELOCs” in terms of origination volume. (The Fed report is a measure of loan balances, not originations.)

“The $60.1 billion fourth-quarter 2022 volume of HELOC loans was down 17% from $72.3 billion in the third quarter of 2022, but still up 27.4% from $47.2 billion in the fourth quarter of 2021,” a recent market assessment by ATTOM shows. “Despite the fourth-quarter decline [in originations], HELOCs still comprised 20.7% of all fourth-quarter 2022 loans — nearly five times the 4.6% level from the first quarter of 2021.”

Mirroring the surge in HELOC lending, one of the largest lenders in the country, Bank of America, reported in its fourth-quarter earnings release that the bank’s overall home-equity loan balance increased from about $4.9 billion in 2021 to $9.6 billion at yearend 2022. HELOCs were not broken out separately in that report.

HELOCs are revolving debt that, in the case of a 30-year HELOC, for example, involve a draw period of 10 years and a repayment period of 20 years. Unlike fixed-rate, lump-sum second-lien home-equity loans — HELOCs normally carry variable interest rates. HELOCs also are popular because the interest on the loans is tax deductible if the funds are used for approved home renovations.

“The direction of interest rates this year will dictate whether HELOC activity stays high as a portion of overall activity or households return to cash-out refinancing deals to help pay for big-ticket expenses,” said ATTOM CEO Rob Barber. “Broadly speaking, if HELOC rates rise faster than those other lending types, then HELOC activity will likely drop, especially if a notable gap develops between HELOC and refinance rates.

“…In the opposite scenario, with better terms on HELOCs, there is a better chance of those types of mortgages growing in number and dollar volume.”

With all the competing headwinds and tailwinds at work in the current market, Barber added that it’s an “especially hard moment to predict which way prices, or HELOC borrowing, will trend in 2023.”

“If there’s a recession and unemployment rises, it would not be a surprise to see HELOC activity do anything but drop,” he said. “But barring that, interest rates, prices and equity [levels] should be the key forces guiding credit-line borrowing.”

Shared-equity market

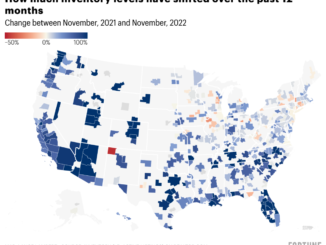

The Black Knight Mortgage Monitor reports that softening home prices resulted in tappable equity levels declining nationally by $2.3 trillion over the final two quarters of 2022. Still, tappable home equity nationwide exceeded $10 trillion at yearend 2022. Tappable equity is defined as the amount of available to borrow against while still maintaining a 20% equity stake.

“You have this really interesting dynamic … where you have nonbank lenders [among them Spring EQ and Figure] getting more active in the [home-equity lending] space, combined with an extreme rise in rates and, the third thing, is just the accumulation of total home equity in the U.S.,” said Peter Silberstein, chief capital officer, at Unlock Technologies, a fintech operating in the shared home-equity investment space. “[Most] homeowners are out of money [with low-rate mortgages], and the vast majority of them are sitting on enormous, historic amounts of home equity.

“In a positive way, this perfect storm that lends itself to more HELOC, second-lien debt and now home-equity agreements (HEAs).”

Unlock and an increasing number of other companies like it (such as Unison, Point, HomePace, and Hometap) are part of an emerging business segment in the home-equity space that serves borrowers who may not want or qualify for a traditional home-equity product like a HELOC. Instead, they offer homeowners a product called a shared-equity contract or agreement in which homeowners are provided cash upfront in return for a share of the equity in their homes.

At the end of the contract period (10 years in the case of Unlock) the homeowner must settle the terms of the contract either through a direct payment, refinancing or the sale of the home.

“One flavor [of a shared-equity agreement] is where the investor shares the appreciation and depreciation on the home, so at the end of the contract, the investor receives back their original dollars, plus a share of the appreciation or minus a share of the depreciation,” said Jim Riccitelli, CEO of Unlock. “Our contract is little different in that we share part of the entire home value at the end of the contract. It’s just different mechanics.

“… We serve the nonprime customer, those that have FICO [credit] scores that are lower than what you might see the HELOC originators doing. And we have more of an asset-based underwriting not focused on debt-to-income ratios.”

Silberstein explained that some homeowners are eligible to tap into their home equity using a debt instrument, such as a HELOC. “And then there’s a lot of them that aren’t,” he added,

“That’s where Unlock and the broader HEA base comes in,” he added, “and helps those homeowners tap into that home equity, so to me that remains an enormous tailwind on the consumer demand side.”

To date, Unlock has served more than 3,400 homeowners and originated more than $330 million in HEAs, according to Michael Micheletti, head of marketing and communications for Unlock, who added that the company does not release data on contract-default rates.

A publication reviewing the HEA market, published by The Kingsbridge Alternative Strategies Fund, states that the chances of a qualified homeowner defaulting on HEA obligations is low, at about 2%, because the contracts are extended to homeowners “with sufficient equity in their homes.” The report adds that among the most likely default scenarios for a shared-equity contract is when a homeowner “fails to pay senior loan obligations,” — in other words, failing to make payments on the primary mortgage note, leading to a foreclosure.

Another major player in the shared-equity investment (HEI) market is the real estate investment trust (REIT) Redwood Trust. Of Redwood’s total capital-investment outlays of $1.3 billion as of yearend 2022, some 13%, or about $171 million, was committed to the home-equity investment, or HEI, space. Since it began investing in the HEI business in 2019, Redwood has committed gross capital to the sector totaling $316 million, according to a recent filing with the U.S. Securities and Exchange Commission. The REIT currently has investments in two HEI originators — Point and Vesta Equity.

“We’re certainly pleased with the investments we’ve made to date and how they’ve performed,” said Dash Robinson, president of Redwood Trust. “We also think that the market is still in its very early stages [and] definitely ripe for innovation.

Toohig at Raymond James said we are in a cycle in the market where many homeowners are saying, “I love my mortgage, but I hate my house.”

“They’re saying, ‘I like my 3% mortgage, and I’m not going to list my house, but I’m just going to stay in my house, and I’m going to make it better,’” Toohig explained. “And if you subscribe to that particular conversation, then home equities and home-improvement loans are going to have a very good 2023, and higher rates mean that people are going to spruce up the home they’re in because they can’t find the home they want.”

Toohig added that despite his company’s “monster” of a year in 2022 trading HELOCs, he and others on his trading desk still wonder: If there had been more HELOC supply, could they have sold even more loans?

“One by one, we’re seeing more lenders stand up new [HELOC] programs,” Toohig said. “So, we do see more supply coming online, and I’m really curious to see how that goes in 2023.”