After one of the largest speculative bubbles in history during the pandemic, the US housing market is now slowly tanking.

Median home prices in the United States had risen about 45% in two years from Q1 2020 to Q1 2022, massively outrunning gains in wages and GDP.

The Fed then hit the brakes, taking mortgages from 3% to 7% in the next six months and ballooning the monthly payment required to buy a median-priced home.

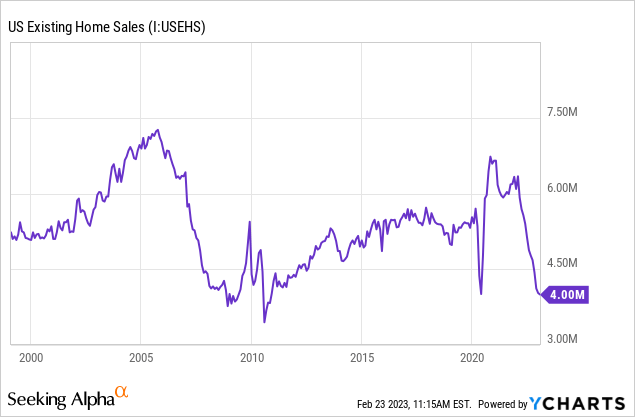

Now, we’re starting to see the tightening work its magic on the housing market, with existing home sales plunging, purchase mortgage applications down to levels last seen in 1995, and price declines averaging a bit less than 1% per month.

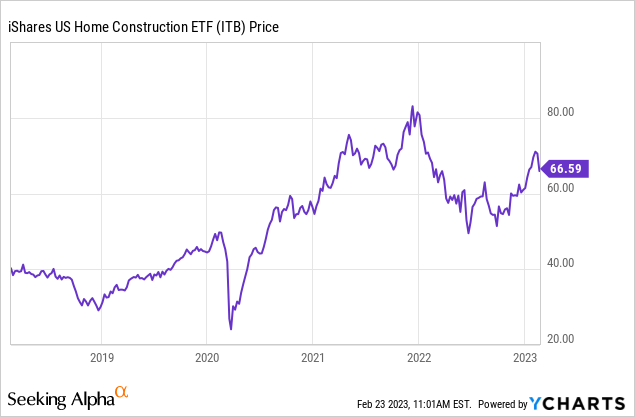

Despite this, housing-related stocks have levitated, as the entire market hopes that the Fed will pivot and things will go back to the old pandemic normal of panic buying.

Since the lows in October, the iShares Home Construction ETF (BATS:ITB) is up an astonishing 31%, despite steadily worsening housing market fundamentals and mortgage rates threatening to push back above 7%, 8%, or higher.

The past few weeks have thrown some cold water on the rally, however. Home Depot (HD) recently disappointed investors with falling sales.

Even as far back as January, there were some warning signs, such as KB Home (KBH) reporting that buyers canceled 68% of contracts.

Are investors in housing and housing-related stocks whistling past the graveyard? Are we about to have a Minsky moment in housing? Let’s dig in.

Led by homebuilders and the cheerleaders at the NAR, there are housing mania deniers out there who insist that DTI ratios of 45% are perfectly reasonable for middle-class families buying middle-class homes, or that you should “date the rate and marry the house,” or that housing is always a sound investment.

Home builders tout their backlogs of interested buyers, but after seeing cancellation rates, I question whether these buyers are actually going to pull the trigger once they see the monthly payment they signed up for.

The truth is that the 21st-Century housing market is a highly-leveraged, speculative enterprise that makes or breaks the lifetime finances of young families – depending on how good they are at timing the market. It’s a “hunger games” of sorts, except the prize is often a house in the desert or swamp.

A lot of people intuitively understand this, especially those who lived through the last bubble in the 2000s. As a result, we’re seeing fewer and fewer people participate in the housing market.

Existing home sales peaked at about 7 million per year in the 2000s bubble, but peaked at a slower pace of about 6 million during the pandemic bubble – despite a larger population.

The high cancellation rates of homebuilders further show that buyers don’t want to buy at the top, and they don’t want to be burdened with excessive monthly payments for a house.

Existing home sales are near 2008 lows, and there’s no indication that they’ll even bottom there. And purchase mortgage applications are indicating what may be on deck next.

Source: seekingalpha.com