Another week down in 2023 and we’re seeing crazier action in the housing market as purchase application data fell, mortgage rates rose again, and weekly inventory took another dive with a noticeable move lower in new listing data.

Here is a quick rundown from last week:

Purchase applications fell 6% weekly as the market digested the first round of higher rates.

Weekly housing inventory fell again by 6,858, keeping the post-2020 theme that housing inventory bottoms out a bit later than usual.

The 10-year yield had a rough week, almost reaching 4% intraday before falling Friday afternoon. Mortgage rates hit 6.80%, marking the high point for 2023 so far.

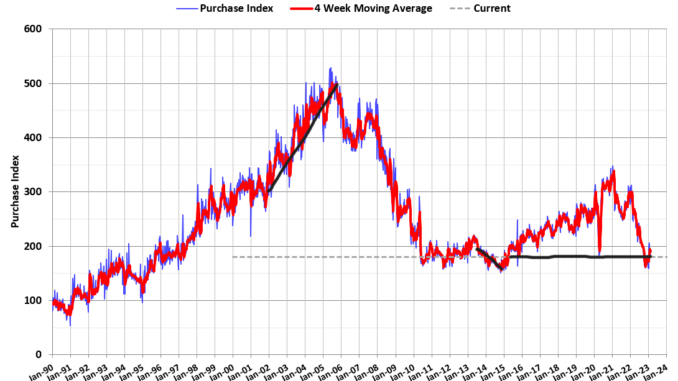

Purchase application data

As mortgage rates have risen, it is critical to track forward-looking data to see how those rates affect purchase application data. After mortgage rates fell from a peak of 7.37% last year to 5.99%, we saw the forward-looking purchase application data improve. However, as rates have moved back up from 5.99% to 6.80% now, we need to check to see how much damage this does.

Last week we saw purchase application data fall 6% weekly, down 42% year over year. Now while the recent bottom has been formed in this data line, we need to be more mindful of the current higher mortgage rates and how those can impact the data 30-90 days from now.

One thing to remember here is that we had a titanic dive in this data line. Last week on CNBC, I tried to get people to understand that the first move coming from a massive dive in demand can seem very strong, but without follow-through action, it’s just a bounce.

Traditionally in a rising marketplace, we would see year-over-year growth in purchase application data all year long. Over the year, the year-over-year comps will get easier and more accessible, so if housing bounces back, we should see some positive year-over-year data later in the year. If this happens, it would be the first time we’ve had positive year-over-year data with purchase apps in a while.

However, as we can see, being down 42% year over year, we are far from having that reality.

Weekly housing inventory

Traditionally, the weekly housing inventory would bottom in January, and we would see the inventory rise for the spring and summer, then have that inventory decline in the fall and winter. Things are different post-2020, and inventory is bottoming out later in the year. For the last two years, inventory bottomed in March and April.

According to Altos Research, last week’s inventory fell again by 6,858 and is more than what we saw last year, but we are working from higher numbers this year. Hopefully, we are getting closer to the end of the seasonal inventory drop.

Weekly inventory change (Feb.10-Feb. 17): Fell from 443,416 to 436,558

Same week last year (Feb. 11-18 ): Fell from 249,161 to 247,385

Why are we seeing another year of inventory bottoming out later in the year?

– Housing demand has gotten better since Nov. 9, 2022, so if purchase apps look out 30-90 days, and we have had three months of better data, then it makes sense inventory is falling, partially to be demand

– New listing data is still declining year over year, and this, combined with the two reasons above, should help you connect the dots. Look at this new listing data for this week compared to other years:

2019 – 65,868

2020 – 62,447

2021 – 50,671

2022 – 49,159

2023 – 42,769

On Tuesday we’ll get NAR’s existing home sales report; then, the report has the backdrop to have another inventory fall, getting us closer to the all-time lows in inventory we had last year, around 860,000. In the previous report, we had 970,000, and we will see what the month of January will bring.

Here is a look at how the 2022 inventory monthly data looked from NAR.

This will be an exciting week of inventory from the NAR side, but also on the weekly data to see whether 6.80% mortgage rates get fewer people to list their homes to sell and buy another one.

10-year yield and mortgage rates

In my 2023 forecast, if the economy stayed firm, my 10-year yield range is between 3.21% and 4.25%, equating to mortgage rates staying in a range of 5.75% to 7.25%. For some time now, I have discussed how it would be hard to break under 3.42% with follow-through bond buying, meaning mortgage rates would fall further. The market made a few attempts to break that level, but bond yields have reversed higher.

We have had a few more robust reports on the economic and inflation side of the equation to help push the 10-year yield to another critical level for 2023. We are in the middle of the range and the 10-year attempted to break higher Friday.

At market close the 10-year yield looked calm, but the intraday action was pretty wild, like when we tried to break below 3.42%. As you can see, the 10-year yield pushed above 3.90% to end the day with little movement.

This week, a case can be made that mortgage rates get better after an oversold bond market condition, but that’s the only reason rates would get better this week. One concern I have is that higher mortgage rates can force potential sellers to hold off on adding inventory this year.

The week ahead

This week we have some home sales data to look at; those reports will most likely be positive since the forward-looking housing data started to get better on Nov. 9. Because that data looks out 30-90 days, we should be seeing it in the existing and new home sales data soon.

We also have the Fed minutes coming up Wednesday, where we get to hear what they’re talking about when discussing the future of rate hikes. However, the big day this week would have to be Friday, when we have new home sales but also the Personal Consumption Expenditures report. The PCE is the inflation metric the Fed tracks when they talk about a 2% growth rate of inflation.

The Fed has said they’re looking at three, six, and 12-month inflation rate gauges to determine rate hikes. Mostly, they have said they want the Fed funds rate to be roughly 5% or 5.25% and just let it stay there. They don’t want to get aggressive from here because if the labor market breaks on them, the bond market will lower bond yields, and mortgage rates will fall, forcing them to adjust their rate-hike stance.

They have repeatedly wanted to keep rates higher for a more extended period. In their mind, if they over-hike now, this will blow back on them quickly. It would be problematic if the labor market breaks while the growth rate of inflation cools down.

For now, the Fed can manage this as jobless claims, which come out every Thursday morning, are still far from my critical level of 323,000 on the four-week moving average. We are still below 200,000 of total jobless claims.

This week is another big week of housing market data to take in, with some key things to track that could impact inventory. I am looking at the purchase application data to see how much damage rates at 6.80% did first, and, of course, the Friday PCE report. Get ready for another wild ride in the economic wilderness.