The 2022 housing market was largely characterized by the swift slowdown in demand caused by rapidly rising mortgage rates. However, even as existing home sales fell 17.8% year over year in 2022, according to data from the National Association of Realtors, home prices still managed to rise 5.8% for the year as a whole, according to the S&P CoreLogic Case-Shiller National Home Price Index, released Tuesday.

Nationwide, home prices posted an annual gain of 5.8% in December, down from 7.6% in November, bringing the index to a reading of 294.68. On a month-over-month basis, the U.S. National Index was down 0.8% in December.

“The cooling in home prices that began in June 2022 continued through year end, as December marked the sixth consecutive month of declines for our National Composite Index,” Craig Lazzara, the managing director at S&P DJI, said in a statement. “The National Composite declined by -0.8% in December, and now stands 4.4% below its June peak. For 2022 as a whole, the National Composite rose by 5.8%, the 15th best performance in our 35-year history, although obviously well below 2021’s record-setting 18.9% gain.”

With mortgage rates on the rise over the past few weeks, Lazzara expects home price growth to continue to slow.

“The prospect of stable, or higher, interest rates means that mortgage financing remains a headwind for home prices, while economic weakness, including the possibility of a recession, may also constrain potential buyers,” Lazarra said. “Given these prospects for a challenging macroeconomic environment, home prices may well continue to weaken.”

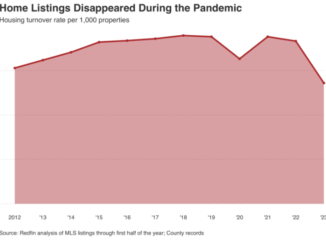

Lisa Sturtevant, Bright MLS’ chief economist, noted, however, that persistent low inventory conditions are keeping prices elevated in many markets.

“Low inventory has propped up home prices in many markets,” she said. “Places where there have been year-over-year price declines are those that boomed during the pandemic, including second home markets and rural communities at the fringes of urban areas.”

The Case-Shiller home price indices for December is a three-month average of closing prices in, October, November and December. Because most home sales take several months from contract to closing, the data likely includes some deals struck in August and September.

Home price growth in the 10-city composite index also slowed in December, recording an annual gain of 4.4% to a reading of 310.64. In November, the 10-city index posted a yearly increase of 6.3%. Compared to a month prior, the 10-city index was down 0.4% before seasonal adjustment in December.

The 20-city home price index posted a 4.6% annual increase, down from 6.8% in November, bringing it to a reading of 298.70. Month over month, the 20-city index dropped 0.5% before seasonal adjustment.

Miami (15.9%), Tampa (13.9%), and Atlanta (10.4%) again reported the highest yearly price gains among the 20 cities analyzed. Despite the sizable gains posted by these three metro areas, all of the 20 cities analyzed, including Miami, Tampa and Atlanta, posted lower price increases for the year ending December 2022 versus the 12 months ending November 2022.

“Prices fell in all 20 cities in December, with a median decline of -1.1%. Moreover, for all 20 cities, year-over-year gains in December (median 4.4%) were lower than those of November (median 6.4%). We noted last month that home prices in San Francisco had fallen on a year-over-year basis. San Francisco’s decline worsened in December (-4.2% year-over-year); its west coast neighbors Seattle (- 1.8%) and Portland (+1.1%) once again form the bottom of the league table,” Lazzara said. “As was the case last month, December’s best performers were all in the Southeast. Unsurprisingly, the Southeast (+12.5%) and South (+11.6%) were the strongest regions, and the West (+1.2%) continuing as the weakest.”